On this blog, retiring by age 35 is a not-so-secret goal of mine.

But in the real world, I tend to keep that secret much more closely guarded.

That’s because most people are conditioned to believe in a 40 year working career, followed by just a few short years of enjoying life before they kick the bucket. If you dare try to live life on your own terms, these people will do their best to convince you you’re insane.

Thankfully, in chasing my goal, I enjoy the benefit of a few early retirement trailblazers before me. These guys and gals are key in convincing myself that I’m not completely crazy for trying to break the mold.

What’s fascinating though? In my years of reading up on their stories (and even having the privilege of meeting some in person!) I’ve noticed clear patterns to their strategies.

More specifically, I’ve noticed the type of person who successfully cuts their working career in half usually falls into three different categories.

1. The Frugal Index Fund Investor

Personally, I find the Frugal Index Fund Investor the most inspiring. That’s because typically, this early retiree worked an average job and blazed their path to freedom through brute savings and disciplined investing… two actions repeatable by pretty much anyone.

Their strategy:

Two words – Savings. Rate.

The Frugal Index Fund Investor is all about maximizing their savings rate in any way possible. Usually, this is achieved by focusing with a laser like intensity on the big 3 expenses.

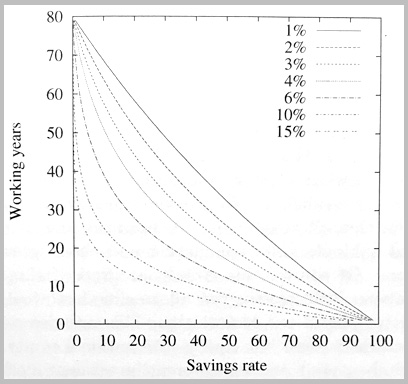

That’s because they understand the following chart so well, you’ll wonder whether they’ve got it tattooed on the back of their hand:

As the above chart shows, The Frugal Index Fund Investor knows that saving more money directly reduces the length of their working career. Because of this, The Frugal Index Fund Investor often judges an item’s cost not by its price tag, but by how many years it will add to their retirement date.

How to spot them:

Because The Frugal Index Fund Investor’s wealth is almost entirely hidden in the stock market, they can be nearly impossible to spot. (At least until they announce their shocking retirement… 15 years earlier than the manager who hired them!)

Don’t be surprised if this person is secretly your neighbor, living in a modest house and driving an unassuming old beater!

Nonetheless, The Frugal Index Fund Investor stays motivated by the unmatched security of their top secret collection of index funds. Often, that silent collection totals hundreds of thousands, maybe even millions of dollars.

Coworkers won’t be able to put their finger on it, but they will notice this person has an unusually carefree attitude towards office politics. Even stranger, this person stays conspicuously silent during any of the office gossip about car payments, mortgage balances, and other day to day money problems plaguing their peers.

Likewise, friends and family might be confused by The Frugal Index Fund Investor’s seemingly random (but actually long-thought out) splurges, and general lack of any money related stress.

How they retire early:

Typically, The Frugal Index Fund Investor uses their stable career to max out their retirement plans, and then funnels any extra savings into a basic three fund portfolio at Vanguard. Although sometimes, they’ll really mix things up by funneling their savings into a three fund portfolio at Fidelity!

The result is that they usually save well over 50% of their income. After 10-15 years of compound interest, they’re approaching millionaire status. (If not multi-millionaire.)

Then, the Frugal Index Fund Investor confidently pulls the plug on the working grind. That’s because they understand the 4% rule inside and out, probably have an even better understanding of the tax laws than your accountant, and use both to optimize their retirement income and spending with a level of precision that would make a NASA Engineer proud. (Which makes sense, because for whatever reason, this person is almost always an engineer. Or some other highly analytical career path…)

For the next 50 years, the Frugal Index Fund Investor lives a carefree life off the interest of their investments. It’s a notable paycut, but they don’t care – they never got close to spending their full salary anyway!

At some point in that 5 decade time frame, The Frugal Index Fund Investor gets bored, takes up a hobby, and accidentally starts earning a side-income. Before they know it, they realize one of life’s great ironies. After a lifetime of optimizing their finances in every way possible, they’re now swimming in more money than they know what to do with.

Notable Examples:

Definitely the most famous example of The Frugal Index Fund investor is Mr. Money Mustache, who I profiled in this blog’s first Financial Freedom Spotlight. He worked a software engineering job for less than a decade, and then retired at age 30.

Then there’s Jacob Fisker, the guy who literally wrote the book on retiring early. He was an astrophysicist who lived off $7,000 a year. He retired after working for just 5 years.

2. The House Hacking Real Estate Guy

When it comes to retiring early, The House Hacking Real Estate guy has a pretty big advantage – he lives for free!

Their strategy:

Rather than taking the most common path to real estate, the House Hacking Real Estate guy ignores all the traditional advice about a “starter home.”

That’s because their first home has nothing to do with white picket fences, three extra bedrooms, or over-sized mortgages. Instead, they buy a first home which allows them to “House Hack.” This means purchasing a town-home, duplex, or triplex, and then finding a tenant or two to help out with the mortgage.

And by help out, I mean that thanks to the minor inconvenience of sharing walls with their tenants, The House Hacker now receives enough monthly income to completely cover their cost of housing. So long, expenses!

Intoxicated by their first-hand experience with the power of real estate, The House Hacker begins looking for the next property. And they begin their transformation into “The Real Estate Guy.”

(Of course, since they’ve completely slashed their living costs, it doesn’t take long before they’ve saved up their next down payment!)

Soon, they’re buying another rental property. And another. And another…

How to spot them:

The House Hacking Real Estate Guy is pretty easy to spot. They’ve almost always got a roommate or two, they’re constantly scouring Zillow and Redfin for potential deals, and if you hold a lengthy conversation with them, your head may start spinning as they casually mention their ownership in property after property scattered across the area.

If they’ve since moved out from their original roommate setup, usually you can still spot The House Hacker by their handiness. Often, The House Hacker owns a minor fleet of construction tools, is happy to offer advice on your own home ownership concerns, and for some reason, always seems to have a house project or three they’re working on.

How they retire early:

Done right, The House Hacking Real Estate Guy can build wealth at a pace and consistency that’s staggering.

With each additional purchase, The House Hacker adds a little bit of cash flow to their monthly income statement. $200 a month from the property over here, another $400 a month from the property over there.

In a few years, they’ve gone from make-shift landlord to the tycoon of their own mini-real estate empire.

Eventually, the cash flow they receive from their numerous properties is enough to completely replace their salary. Then, they walk away from their usual career in favor of answering tenant phone calls once or twice a month and, more importantly, collecting rent checks.

Notable Examples:

Maybe my favorite example of the House Hacking Real Estate Guy isn’t a guy at all! Paula Pant over at AffordAnything.com bought a triplex near Altlanta, lived in one unit, and then rented out the other two to cover her mortgage. Today, she’s a 34-year-old full-time blogger/podcaster who owns 8 homes.

Then there’s Scott Trench. He wrote a fantastic book called Set for Life. In it, he advocates House Hacking as the main strategy to quit your job as fast as possible. Today, he’s the CEO of BiggerPockets.com, probably the biggest online real estate community.

And for somebody who’s in the process of crushing it with House Hacking, there’s my friend Drew from GuyonFire.us. He used a mixture of house hacking and his four rental properties to put me to shame; he’s grown his net worth by $500,000 in the past four years.

3. The Hustling Entrepreneur

The Hustling Entrepreneur follows the oldest path to early retirement in the book. Interestingly, it’s also the most powerful.

Their Strategy:

For every Bill Gates who drops out of college to become the richest man in the world, there’s another entrepreneur that’s a little more relatable for the rest of us. And that’s The Hustling Entrepreneur.

The Hustling Entrepreneur lives by another two words: Sweat. Equity.

Sometimes, their business revolves around an ingenious Shark Tank style solution to an everyday problem.

Honestly, this thing is brilliant.

Honestly, this thing is brilliant.Other times, the business idea is far more boring, like an employee who realizes they can start using their knowledge to provide consulting or take on additional clients on the side.

In either case, the part that makes all the difference is the same. The Hustling Entrepreneur EXECUTES.

They dedicate nights and weekends to obsessing over their business. As the business grows, so does its valuation, which opens the floodgates to the fastest way to wealth in the world…

How to Spot Them:

It might be hard to spot The Hustling Entrepreneur, simply because they’re usually too busy working on their business to ever be around!

How They Retire Early:

A successful business owner builds themselves a wealth creation machine more powerful than any other. And they give themselves three options for “retirement.”

- If The Hustling Entrepreneur earns enough to quit their job but still feels like hustling, they can just keep running the business while enjoying the profits. Thanks to the scalability of businesses, those profits often provide an income stream that dwarfs anything possible in a salaried position.

- Those who want to retire in the traditional sense can outsource management of the company itself. In doing so, they take a slight reduction in their daily milking of the cash cow, but still enjoy the cash nonetheless.

- Those who want the ultimate lump-sun exit can sell the business entirely. Since businesses are bought and sold at multiples of annual income, the returns here are staggering. A business earning its founders $250,000 a year isn’t just a $250K salary. It’s actually $1.8 million retirement package, because most businesses can sell for around 7 times annual earnings.

Notable Examples:

In the land of the American dream, famous examples of The Hustling Entrepreneur are everywhere.

Jeff Bezos used time away from his job as a finance employee to work on a website that would sell books on the internet.

Or there’s Craig Newmark. He was an IBM employee in the early 1990s, living in San Francisco and struggling to meet people. So, Craig decided to create a List to help him organize meetups. Today, CraigsList.com earns over half a billion dollars a year.

Which Early Retirement Person Are you?

And here’s another interesting thought. How fast could you retire if you borrowed strategies from all three?

Related Articles:

Another great article, Sean. Your emails are basically the only ones I consistently open. Thanks for providing quality content.

I’m using index fund investing and real estate currently. “The Working Entrepreneur” strategy is also in the works.

That’s awesome to hear, Joe! Thanks.

Great post! I read all of the new articles you write. It has been fun to follow along your journey and I like this high-level view; it would have helped me early on a lot if I was getting introduced to the world of FIRE. I’m a mix of the first and last one currently (no real estate), but my partner is more focused on the second.

I also re-read your “3 Fund Portfolio: The Lazy Investing Strategy that Crushes the Pros” post this morning. Can I ask why you invest in VBTLX, and not VBLAX (Vanguard Long-Term Bond Index Fund)?

They have similar profiles and expenses, but it seems the general rule of thumb is to invest in bonds that match your time horizon (in this case, long-term).

Good question. Both are good funds. My thought process at the time was that the interest rates between VBTLX and VBLAX were so close, that I didn’t feel like I was being compensated for the added “risk” of holding longer term bonds in a rising interest rate environment.

I’m not 100% set in this belief though, and I’ve seen some good counter-arguments that it’s better to just hold long term either way.

Another reader also pointed out that I’d probably come out ahead in one of Vanguard’s tax free bond funds due to my higher tax bracket, although the tax free yields seem to have fallen lately and that may no longer be the case.

Well this discussion is timely 🙂 I received a notification from Vanguard today that VBLAX will now have a “0.5% purchase fee for all new purchases and exchanges into the Fund’s mutual fund share classes, including purchases completed through direct deposits, automatic investment plans, automatic exchange services, and directed dividend plans.”

Long story short, I called them and confirmed this is ONLY happening with this index (it took them a while to figure this out and the agent couldn’t tell me a good reason why this is only happening with VBLAX). After learning this I switched 100% of my non-life fund bonds to VBTLX (JL Collins would be proud heh). Just thought you might find that interesting

It appears you can still buy the ETF (BLV) without that fee.

Nice post! I used to dream of being the entrepreneur – I ran a software company in college (didn’t make it) and joined another company pre-series A after graduating. But after thinking about it and reading articles like the one below (I’m a big fan of The Financial Samurai), I realized the traditional startup route rarely works out.

https://www.financialsamurai.com/the-startup-riches-myth-selling-for-millions-and-being-rich/

Regarding the real estate guy, the crazy thing is that anyone can invest in real estate! Cash flow is really just the tip of the iceberg when it comes to the financial upside.

True, traditional startups are a tough racket. Although I’d argue that Sam’s article really just highlights the importance not giving away ownership. Like he said, building a modest lifestyle business is definitely possible, especially if your main goal is just freeing yourself from your job. (Rather than building Jeff Bezos-style, world domination levels of wealth.)

Real estate is a great path too!

Very true. Ownership is key. My big takeaway from the article is the idea of the “lost income you would have made working for an established firm.”

That being said, I’m a big supporter of a side hustle 🙂

Do any of these people you reference have families? Children…more than 1? How do I as a single mom possibly save 50% of my income with 4 children?

As a single mom of 4 children, I’d imagine your expenses are going to be on the higher side. In which case, saving 50% and going “The Frugal Index Fund Investor” route might not be the easiest path.

Going for “The House Hacking Real Estate (Mom)” may be better choice to cut down your living expenses. And “The Hustling Entrepreneur” route could bump up your income enough that saving 50% becomes easy, even with four kids. Jeff Bezos has four children, too. He’s even a single dad now…

Hi Tannya,

I introduced my friend a single mother of 3 to FIRE over 6 months ago. She was in a bad way, 1 income and all the expenses had put her in a lot of debt. She took a week off and made a plan. Changed to a much smaller house with lower rent meaning the kids had to share a room. Formed a mother’s group where 1 mother carpools n babysits for all kids once a week thus allowing other mothers to work extra hours. Makes all her meals n freezes once a week so kids n her only have to reheat n eat when they get home. There are plenty other hacks and sacrifices she has done so now she gets a bit of surplus so she is cutting down her debt. Myself n other friends baby sit to give her a day off. The kids are also planning odd jobs to earn extra money for themselves. It’s only a beginning and it is hard but she is determined and always trying ways to increase her savings rate. Good luck

I’m probably closest to the Frugal Index Fund Investor myself…though I don’t always stick explicitly to index funds. When opportunities arise, I have absolutely no problem being opportunistic.

I think I’ve been pretty successful as an early retiree, although I don’t actually call myself ‘retired’. That word just has way too much baggage that comes along with it.

Instead, I simply prefer financially independent.

Your comments on the frugal investor hit home, though I’d counter the ‘firm understanding of the 4% rule’ would imply that it may be a difficult proposition for a 50+ year retirement in a world with zero real rates and elevated asset prices.

Enjoyed the breakdown though!

Nice article. I like to think I am a combination of the three altough I probably relate the most to the frugal saving rate index tracker investor.

Having a small side hussle (blog), plan to rent out real estate in the near future, and invest in peer to peer and index funds I hope this combination will allow me to retire early. But of course you never know what comes your way! You can’t plan anything but you can plan the current month and give you a bigger start in the future.