Hey all!

Long time no see.

I’ll apologize upfront for my MIA-ness.

All of the sudden, we were already halfway through September, and I still hadn’t published the August net worth update!

I believe this officially makes me the most behind I’ve ever been on the blog. But I have a good excuse for this one, I promise!

Before we get started, I’ve got to introduce the new readers to the whole idea of these net worth updates. Every month, I track and share my progress towards my goal of financial freedom. I am aiming for about $1 million in liquid assets, which is a number I think will allow me to walk away from mandatory work forever.

I hope that by sharing these numbers, I might inspire others. (Or at the very least, provide a cheap source of entertainment.)

I’m currently 31 and counting T-minus 4 years until I pull the plug, so let’s look at the latest progress!

Life Update: August 2021

Well, this is a big one…

Lady Money Wizard and I got married!

After a 7-year relationship and a two year engagement, (thanks, COVID) the two of us finally tied the knot!

I’ll have all sorts of juicy details about the wedding in a dedicated article, especially since I owe everyone an update about whether we stuck to our absurdly low wedding budget of just $2,750. (You’ll get a teaser in the spending report at the bottom of this update, but spoiler alert: we blew the budget!)

For now, I can just say August was a wild blur of getting everything ready for the big day. Of course, it doesn’t help that I’m a procrastinator by nature, so our “wedding planning” included me almost forgetting to buy a ring and the two of us definitely forgetting to bring the very important marriage license to the courthouse.

Maybe I’m naive, but I was also surprised just how much work goes into throwing even a modestly-sized party. And I don’t even know what I’m complaining about… our total guest list was well below 50 people.

(Respect to anyone who hosts one of these 100-300 person mega-weddings. You people are bosses. Or psychopaths. I’m still not sure which.)

No worries though… the whole thing was a blast, and I’m definitely excited to start this new phase of life.

Stay tuned for some updates about all the wedding details, plus grown up stuff like combining bank accounts and a re-evaluation of where we stand on those early retirement goals, now that there’s officially two people on Team Money Wizard.

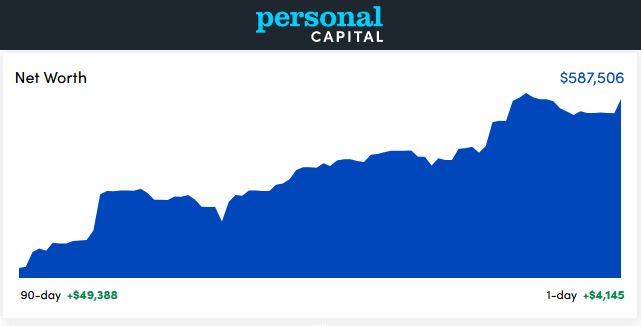

Net Worth Update: August 2021

Of course, this is more like “Net Worth Update: August and half of September 2021” but that’s what happens when this website’s only employee spends the first half of the month completely unplugged on a Hawaiian beach.

Lots of changes that I’ll explain below, although most of the really crazy movement seems to be a product of this being an update for the past 1.5 months, instead of our usual 30 day window.

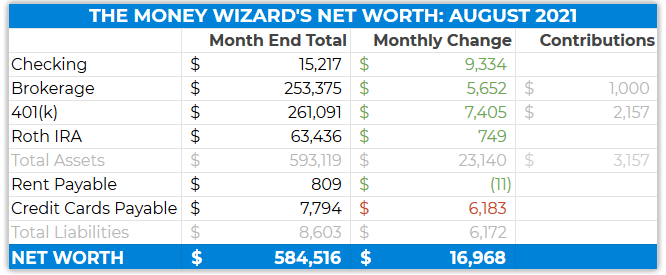

Checking: $15,217 (+$9,334)

A massive increase for a few different reasons.

- This is 1.5 months of gain, so there’s an extra paycheck or two in there.

- I have a massive credit card bill that hasn’t come due yet, so the cash balance should fall hard next month.

- Despite our most sincere “no gifts” policy at the wedding, we did get a couple wedding gifts. Those old grandparents can be persistent!

Brokerage: $253,375 (+$5,662)

$1,000 of contributions this month, and the rest is market gains. I did set up those automatic Vanguard contributions into VTSAX, and I’ve gotta say it’s pretty awesome to have your money automatically invested for you while you’re busy getting married, or whatever else life calls for.

For more info, read my article Create a Wealth Building Machine by Automating Your Finances

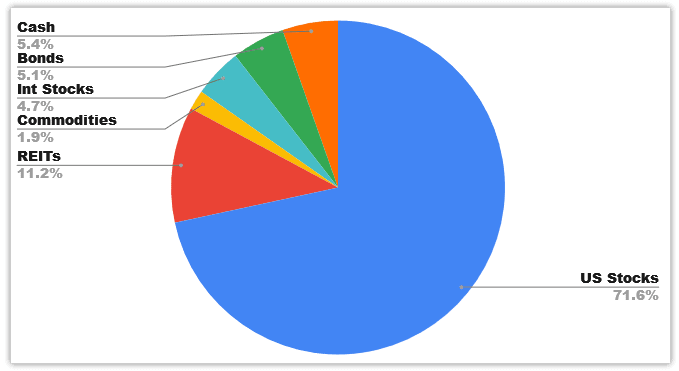

You can also read previous net worth updates to see a more detailed breakdown of my brokerage account, but it’s mostly just boring old index funds, plus some silly investments from when I was a teenager.

401(k): $261,091 (+$7,405)

I max out my 401k to the full IRS-allowed $19,500 each year. So, given the timing of this update, I think there were actually three (or possibly four) paychecks worth of contributions here.

Those contributions are still broken down as:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

Roth IRA: $63,436 (+$749)

Just market movement here, since I maxed this one out in January. The portfolio still includes:

- Vanguard’s REIT Index (VGSLX) – about 75%

- Vanguard’s International index (VTIAX) – about 25%

I talk about why I like VTIAX more than VFWAX here.

Credit Cards Payable: $7,794 (+$6,183)

The big one!

Loooots of wedding spending (and honeymoon spending, but we’ll get to that in the September update) included here.

It is especially worth repeating in a month where the credit card balance is unusually large: I never pay credit card interest, and you shouldn’t either.

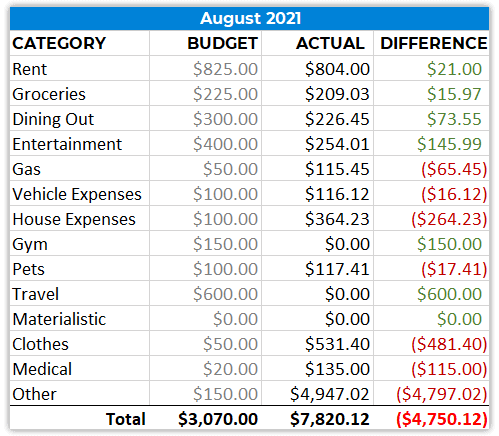

I’ll include a total breakdown of the cost of the wedding in another article, but for now here’s a glimpse at August’s overall spending:

Total August Spending: $7,820

A new record!

Is it even worth discussing any category except for the “Other” category?

In August, that “other” category translated to the “Wedding” category. That said, it’s too much to cover here, so stay tuned for a whole post about this.

Otherwise, I did go a little crazy in the clothes category. Here’s what happened…

In preparation for the wedding, I tried on my trusty business suit, which for the past decade has been my wingman through college interviews, formal work meetings, and the rare suit-worthy event. After taking one look in the mirror, I just had to laugh at how much it didn’t fit.

No worries, I thought, I’ll just bring it to the tailor….

And that’s what I did, except the tailor took one look at me, looking me up and down on a single pass, and simply said, “You need a new suit.”

As it turns out, the healthier lifestyle of COVID work-from-home has changed my body type a bit, and my suit was beyond salvaging.

In other words, that tailor slapped me in the face with the epiphany that I might actually need a new wardrobe.

To the mall I went, and $500 later I’m a little better set up for looking presentable. Although I do still need that new suit…

How was your August (and half of September)?

Apologies for the update being so late this month. We’ll have lots of fun new content coming out soon!

PS – If you’re serious about tracking your net worth, here’s my favorite tool to do so.

Related reading:

Congrats Money Wizard! My wife and I got married at a smaller ceremony last summer during the June Covid lull but had our reception over Labor Day weekend! It was a little bigger than your party (I think we had 120) and that felt huge. I can’t imagine how the 300 guest megaweddings feel.

Quick question: I noticed that you have your Roth IRA primarily invested in a REIT fund. What’s the benefit of this fund over a stock index fund? I’m assuming part of it is diversification without having to purchase a rental property, but does it also provide really good dividends and decent growth?

Congrats to you, too!

I am finishing up a post now about why I like VGSLX in my Roth. The short answer is diversification, the long answer has to do with tax efficiency.

Thanks for the update and congrats!!

Question – when you say “ T-minus 4 years until I plug the plug” what do you mean by that?

Early retirement, hobby work, or some other option?

Thanks! And yeah, retiring from corporate America and instead going for paid hobbies, knowing that you could stop them at any time and still be fine. This article talks about that strategy:

https://mymoneywizard.com/retire-age-35-4-million-net-worth/

Congratulations on your marriage!

Thanks, Amanda!

Congrats my frined!!!!

We also are getting marryed on december, same as you liettle party of 40 persons, but big expenses in outfit (my future wife wanted something special),but in general we are in budget.

Abrazos desde México!!!!

Congrats to you, too!

Congrats to Mr (and Mrs) MW on tying the knot!

$500 shopping spree! You’ve changed (*this is a joke in case my humour isn’t coming across in the keyboard!*). I guess you did try to get by with the existing threads but tailor said “no”.

BTW when you write “As it turns out, the healthier lifestyle of COVID work-from-home has changed my body type a bit, and my suit was beyond salvaging” is this saying you were able to use wfh to get healthier? If so, that’s awesome, congrats!

Looking forward to hearing how you managed to bring the wedding in for under 5 figures, very impressive.

HH

Thanks!

Yeah I’ve built a mid-afternoon workout into my daily routine, which seems to be working out well.

Congrats on the marriage! And great job keep the cost so low.

Do you think you will be adding Mrs. MW’s new worth to the overall or no?

I haven’t been keeping most of my wife’s investments tracked to keep me more motivated and make things harder to get to our net worth goal.

Sam

Thanks, Sam!

I was planning on combining our net worth, but I also like your approach. We shall see!

Congrats to you.

Also, as a side note, IMHO, event planners (and (wholly unrelated) CNAs) ought to be among the highest paid professions. It’s a difficult and, sadly, often thankless job that comes with no shortage of grief and way-too-high-maintenance clients.

I could definitely see that!

Congratulations!!! Looking forward to all the future posts you have hinted at!!

Thanks, Mike! Should be some fun posts coming up!

Congrats !! By the way, you need to change your profile description to “I’m the Money Wizard, a “30-something” who….” 🙂

Good catch! And thanks!

Congrats on getting married Money Wizard! Will you two be combining your finances together, or shall we continue to expect the numbers as a completely solo affair?

Just curious! Congrats again! That’s a big life milestone!

Curious where things like water, electric, cable, internet, etc. fall into your budget? Wasn’t sure if those expenses were already baked into the rent figure.

As always, really appreciate everything you do! Congrats again on getting married and thanks for your help!

Yep, those are included in the rent payment.

Congratulations. That is so exciting. 🎉🥂