Welcome to VERY SPECIAL monthly net worth update!

As you probably know, every month I track my progress to my goal of about $1 million in net worth, which I’m hoping will allow me to take an early retirement from my white collar office job. I’m currently 30 and hoping to retire within the next 5 years. Read on for the latest progress.

*As always, I am not an expert or financial advisor, so nothing on this site should be considered financial advice. These are just like, my opinions, man. Always do you own research, and always abide by The Dude.

Life Update: February 2021

Not a whole lot to report this month.

Winter in Minnesota + no travel + COVID still existing = a pretty uneventful month.

I’m not complaining though. There’s worse things in life than a comfortable routine.

I got into a groove of working all day, hitting my makeshift basement gym in the evening, and then relaxing over dinner, books, or TV with Lady Money Wizard at night. Mix in a couple sunshine-grabbing walks with The Money Pup and some fancy dinners to keep our sanity, and life is good.

Net Worth Update: February 2021

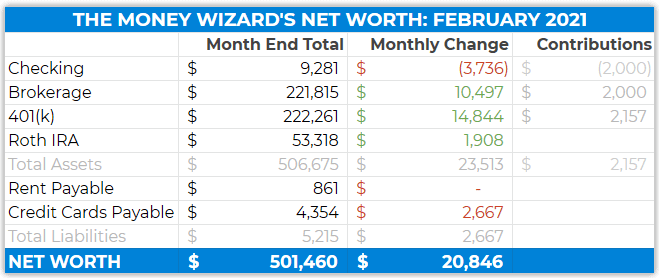

This is usually the part of the update where I insert a nice clean screenshot of Personal Capital’s net worth dashboard. Unfortunately, Personal Capital was on the fritz this month, so we’re stuck with my homemade spreadsheet.

(I’ve been with Personal Capital for the past four years, and this is only the second time in four years this has happened, so I’ll cut them some slack. That said, both times were within the past few months, so hopefully it doesn’t become a trend.)

The big news – half a million!

*insert confetti drop*

*good enough*

How does the illustrious half-a-millionaire mark feel?

Pretty good, actually!

When I started this site, my minimum goal was $750K in savings before walking away from work. Over the years, I’ve increased my spending from around $24K per year to $30-35K. Using the 4% rule, that means a safer target these days is probably closer to a million.

Either way, if building wealth is like a terrifying airplane ride, we’ve officially got liftoff!

The nature of compounding investments means that once you get halfway to your goal (numerically) you’re actually closer to 75% of the way there.

Super counter-intuitive, but take a look again at FourPillarFreedom.com’s chart:

In that example, it takes a whole 22 years to reach $500,000 but then only 8 years to hit $1 million!

In my case, it’s taken me nearly 8 years of full-time work to reach $500,000. (Plus another 7 years of part-time teenage savings.) But I might hit $1 million in just 3-4 more years.

The big wildcards are:

- If/when the next stock market crash hits.

- How much of my salary I save this year. (I’m shooting for another $50,000 or so)

- Whether I hit my hail-mary goal of $36K in side hustle income in 2021.

Either way, I feel like I’m getting so close to the end of that tunnel.

Exciting stuff!

Portfolio Allocation – February 2021

This is also usually the part of the post where I share my exact portfolio allocation. Personal Capital is awesome at calculating that… except when it’s on the fritz. Adding everything up manually is bit of a nightmare, so we’ll put it on hold until next month.

(I suspect it’s still pretty similar to last month, which totaled 65% US stocks, 11% Reits, 10% international stocks, 6% bonds, 6% cash, and 1% gold/silver.) Not mentioned or counted is my larger and larger gamble into cryptocurrencies.

Random note – using the word “fritz” for the first time in forever reminded me of when I was a kid, and the tube TV blew up yet again.

“TV’s on the fritz again!” usually meant it needed a new fuse or some other quick repair, but in either case, it was pretty devastating for a young lad who was missing the latest episode of Are You Afraid of the Dark on Nickelodeon. I had to chuckle at how far our 60+ inch LCD uber-HDTVs have come, and how good we’ve got it these days…

Checking Account: $9,281 ($3,736)

Two main reasons for the drop this month:

- I transferred $2,000 to my brokerage account.

- I bought a lot of inventory for my flipping side hustle that I haven’t sold yet.

Brokerage: $221,815 (+$10,497)

The only action here is that I bought $2,000 more of gold ETFs this month. So, this is mostly a 3% increase in my portfolio due to market growth.

401(k) : $222,261 (+$14,844)

Here’s an interesting quirk – for the first time since I started saving, my 401K actually passed my after-tax brokerage account this month. I guess that’s what happens when an account gets the benefit of $19,500 of automatic pre-tax contributions each year, plus another $7,000 or so from employer matching.

My contributions are still invested like so:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

Roth IRA: $53,318 (+$1,908)

I contributed the $6,000 maximum back in January, so this is just investment returns in action.

The Roth is still roughly:

- Vanguard REIT Index Fund (VGSLX): $38,500

- Vanguard International Stock Index Fund (VTIAX): $13,000

PS – here’s why I like VTIAX more than VFWAX.

Rent Payable: $861 (+$0)

What are the chances my utilities are the exact same two months in a row? More than 0%, it seems.

FYI, I’m still splitting the mortgage on a house that my fiance bought for $180,000 a few years ago. This “rent” covers my half of the mortgage, utilities, taxes, expected maintenance, etc.

Credit Cards Payable: $4,354 ($2,667)

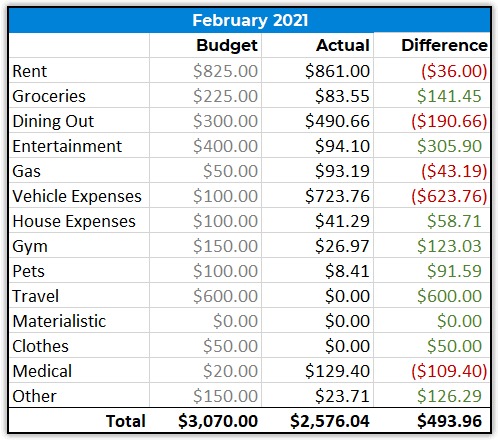

Let’s take a closer look at the spending:

Total February Spending: $2,576

Vehicle Expenses: $724

You might remember that last month I coughed up a $1,000 insurance deductible for doing a Tokyo drift across a patch of ice into a parked vehicle.

When it nearly happened a second time, I got suspicious…

Turns out, those 40,000 mile tires were toast after 35,000. So, I sprung for the best new all-season tires money can buy, figuring if $600 saves me a few thousand in insurance deductibles (not to mention added safety) then it’s a no-brainer.

Medical: $129

I placed a mega-order for the best surgical masks money can buy. (I’m noticing a trend in my spending preferences this month…)

Those masks really are the bomb though – they’re the same ones Dr. Fauci was spotted in, and they’ll make the typical surgical mask feel like cheap tissue paper.

Man, you know it’s a boring year when you’re getting excited about buying surgical masks…

#COVIDLife

Entertainment: $94

To-go coffee and three brewery orders. Can herd immunity show up already?

Gym: $27

Again!?! I haven’t stepped into a gym in months!

I’m just throwing money away on this. Time to cancel…

The first $100K really is the hardest…

It seems like just yesterday that I was starting this blog after hitting my first $100K. (For fun, here’s the first blog post I ever wrote…)

As they say, the first $100K really is the hardest. After that, compound interest starts going nuts.

I truly hope these updates have helped you out in some way!

PS – Want to track your net worth like this? Personal Capital is my favorite tool to do so. The free software is truly awesome, so just check it out already!

Related Articles:

Congrats on that! That’s a huge number. So interesting to follow your journey – a real inspiration.

Thanks – that’s what it’s all about!

Congrats Money Wiz. I’m right on your heels! Your site has helped me immensely from understanding index funds overall a few years ago, the power of compound interest, general spending advice, etc. Now to the point where I am truly adding to my net worth at a rapid pace. It’s awesome.

That is awesome! Keep it up!

Congratulations, MoneyWizard. I can’t wait until I stumble across your blog titled “I hit the million dollar mark!”. I suspect it’ll happen sooner rather than later 😉

Thanks, David. That’s gonna be a surreal one to write!

Nicely done! Momentum alone will get you to your goals, so it’s a safe bet you’ll blow past them soon. Enjoy the ride!

Thanks Paul. I hope you’re right!

I just hit $150K in net worth – $130K of which is invested in the market. Took me right around 5 years from literally nothing. I’m 31 now, so right around the same age as you. With a new job, better spending habits, learning more about finance, watching and reading people like you, compound interest, and depending on what the market returns, I think I can hit the next $150K in less than 2 years. Really inspiring to see somebody with even MORE money than me doing basically the same thing and having MORE success. Keep up the good work. My goal is $1.5 million by the time I’m 41.

That is awesome, Jacques. I have no doubt you’ll reach that goal if you keep it up.

Along with better spending habits, minimal debt and then debt elimination will accelerate your journey to your goal.

Congratulations! A million$$ happens fast now….money makes money! Ten years ago I thought this was the tipping #, and I was right.

One advantage you have that many don’t, is sharing expenses with a loved one. Many don’t have a special someone or want a roommate. Their income has to pay for all expenses and then also find their retirement. Not impossible to build wealth but slower for sure.

True. Moving in with Lady Money Wizard cut my monthly living costs by about $500 per month. ($1,300/month rent in Colorado to $700 per month in Minnesota.) Although some of that was offset by more frequent dinners out, more expensive travel, etc. Before then my net worth was around $125,000.

After that my wealth really started climbing. It’s hard to pinpoint whether that was because of lowering my rent, increasing my salary, or finally hitting that $100K mark. It’s probably a mix of all three!

its likely due to the multi-pronged approach you took.

Congrats man! Reading these a few years has been inspiring thanks for doing this! The 75% of the way there thanks to compound interest is so cool!

I was pretty surprised by that bit too!

My husband and I are really starting to focus on retirement savings (we won’t be retiring super early, aiming for 62 – which is what we want). I’m just curious about your budget since it doesn’t include Ms. Money Wizard’s financials and you split the cost of rent. Are the other costs, such as groceries, dining out, etc split evenly with her or do you pay for most of those type of expenses? The reason I ask is because I’m trying to figure out a better budget than we have currently, but we have all of our money pooled together and together we spend $200-300 on dining out, for example. You are trying to keep your budget at $30-36k/yr but if she is also spending the same amount, then combined, it would be $60k+, correct?

It depends. Housing costs we split exactly 50/50. Groceries are pretty even. Dining out is probably 75-80% me, and I usually pay for more of the travel, too. She definitely picks up more of the pet costs though.

We think an average month for her is about $1,800-$2,000 of spending, which would put our combined spending at $50-60,000 per year.

I’ve decided to combine all our finances after we get married this year, so I’ll have a clearer idea after that.

So, is she also planning to retire at 35 or will she continue to work? I’m just having a hard time figuring out exactly how much I think we will spend after retirement. Our main goal is to live in a cheaper country and hopefully travel for most of it (at least the first 10-15 years, but staying longer in each place to save money). I would say our annual spending is $50-60k but we definitely could trim back some expenses – for example, we spend a lot more on travel now, with the hopes of doing the larger and expensive trips while we’re still wage earners.

She really loves her job so she plans on continuing to work for now. Who knows what the future will bring though! This whole journey is about options, IMO.

Congrats. That is awesome. Great job. It is pretty amazing how quickly compounding kicks in once you get a head of steam. It is like a snowball that just keeps on picking up snow on its way down the mountain. Cheers.

So true.

Congratulations !!!!! Stay on the path, and getting to a million and more will be faster than you may have imagined. I have my own experience to vouch for.

Super encouraging!

This is awesome, congratulations! We’re around the same age and milestone. Perhaps we can connect about your side hustle income? I am on track for > $40k this year (in addition to a day job), would be cool to share notes. I also plan on covering this more on my entrepreneurship/growth blog. Let me know!

Very cool! Feel free to reach out to me through the contact page.

Congrats on hitting that half a million mark, Sean! You truly deserve it! It still feels like yesterday that I was reading your first post of discussing the 1st $100k. You’ve been humble throughout the entire journey, and you’re even still aware that the market could crash at any moment. Take time to celebrate this victory! Pop the bubbly (even if it’s a cheap bottle of champagne)!

Haha, appreciate it, and always great to hear from a long time reader!

How much of that $500,000 has come from contributions? Just curious as to kind of returns you’re getting from the stock market. One needs to remember the stock market is in a 12 year bull run. The longest in history. Most bull runs last 5 years or so with bears markets 6 to 18 months. Hang tough when the market takes a dive and doesnt come back for years.

Good question. I’m going to take a closer look at this eventually. My year-by-year breakdown sheds some light on those numbers.

From what I’ve seen so far, it looks like my portfolio has averaged about 11%, which is about in line with average market returns.

Average return of 11% is really good. The power of compound interest is insane. So would you say you contributed $300k and made $200k in the stock market and investments or more like you contributed $400k and made $100k up until now? The great thing is at one point there’s no need to contribute anything more funds. 🙂

Amazing feat and congrats! Just curious what monthly income you expect to have at 35 (retirement) when so much of your wealth is in your 401(k) and Roth accounts, which for all practical purposes you can’t touch without penalties until you’re 65/67 years old.

That leaves dividends from your brokerage to live off from 35-65. How much are you expecting / how does the math work?

401(k) can be tapped into with a Roth IRA Conversion ladder.

Otherwise, I hope to spend the next few years building up some side income (see this year’s New Year’s Resolutions) that could take over in early retirement. I’ll need a much lower salary once I’m not saving for retirement anymore. 🙂

There we go!! Just gets faster and faster from there! 🙂 Congrats Half-a-Millionaire!

Haha, thanks J$!

OMG you’re getting there so quickly! Congrats!!! What are your post-retirement plans? Flipping and running the blog?

Yeah, I’d like to devote myself to more entrepreneurial style passion projects. Whether that’s blogging, writing a book, flipping stuff, launching a product, or even just volunteering. Ask me in a few years, and I might have a completely different answer!

Congrats on getting to the half-a-milli mark! I’m hoping to reach that within the next 2 years. I remember you saying that you wanted to spend more in certain areas, why not ditch the globo gym subscription and get something more high end? Personal trainer, crossfit, etc. The class or personal coach structure might keep you more consistant, not having to plan workouts…hell…you might even enjoy it. Gotta stay healthy in order to make use of that early retirement!

Good point! I hired that trainer last year to get me into running, and was pretty shocked to find that I sort of fell in love with it! Definitely money well spent.

I actually plan on cancelling the gym this month and moving 100% to my iFit bike, gymnastics rings, periodic yoga classes, outdoor running, etc. Still wish I had a better setup for true weight lifting, but we’ll see.

It’s interesting, that living in Minneapolis with the brutal winters, you never decided to tack on the extra $1,500 and go with an AWD car. Knowing that you will keep the car for at least a decade, and thus the potential arrival of kids to transport, you decided to choose the cheapest option of a small, front wheel drive car. I could understand if you switched to snow tires in the winter, but after these latest escapades, are you regretting not upgrading to a safer option?

Honestly, no. My recent escapade right into another vehicle was a stopping problem, not an acceleration problem. AWD wouldn’t have helped at all.