Well folks, we’re officially halfway done with 2021.

If you met that sentence with a “WTF?” and a double check of the calendar, then I’m glad you and I are on the same page.

So, now’s probably a good time to check on the latest portfolio progress.

If you’re new here, every month I track my progress towards my goal of about $1 million in net worth. I’m hoping that amount will let me leave my white collar office job within the next 4 years.

*As always, I am not an expert or financial advisor, so nothing on this site should be considered financial advice. These are just like, my opinions, man. Always do your own research and consult a professional.

Life Update: June 2021

Some of my least favorite trends on the internet are those Instagram influencers who like to pretend their lives are all rainbows, sunshine, and rainbow sunshine cocktails.

In an effort to rebel against that unrealistic fantasyland, I’ll be honest with you. In June, I didn’t do a whole lot.

I can pretty much sum up the month into three main categories:

- Grinding out that work-from-home life.

- Working on chores around the house.

- Meeting up with a few friends for some low key hangouts.

That repetition aside, the most exciting part of the month was probably putting the finishing touches on our wedding plans, which are now slated for August/September. Exciting stuff indeed!

Although that also reminds me that I need to do some research on the best way to combine finances and all that other grown-up stuff.

Back to the grind!

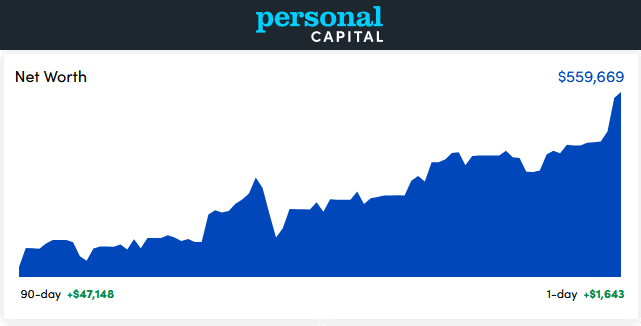

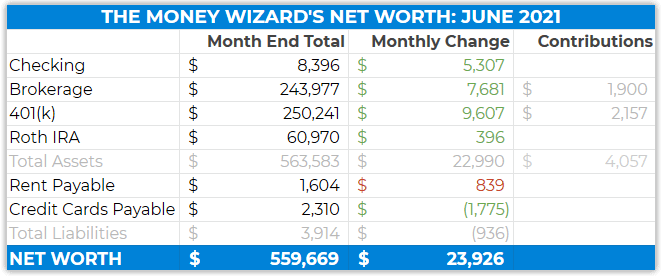

Net Worth Update: June 2021

Financially, June was a home run.

Pretty much every category was up across the board:

It was all fueled by a 2.7% monthly increase to the stock market, which was mostly fueled by the economy adding back jobs, economic prosperity, blue skies, and just a teeny tiny bit of inflation, at least according to the government’s economists.

I’ve got my fingers crossed they’re right and didn’t accidentally mess up the inflation calculation.

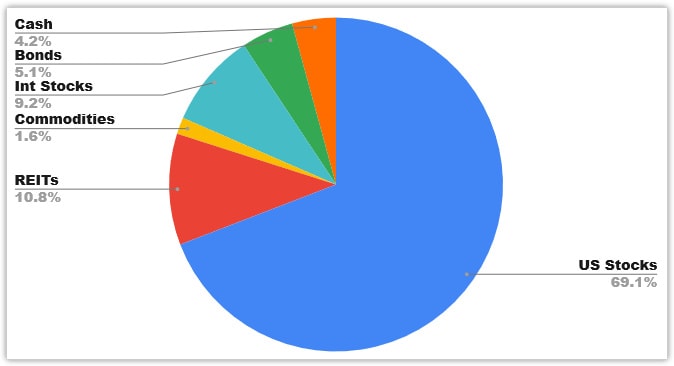

In any case, the biggest monthly change to my portfolio was an increase in my cash amount, from 3.4% to 4.2%:

Checking: $8,396 (+$5,307)

The bad news is that I already failed my goal of keeping the checking account below $5,000.

The good news is that now I get to go on an investment buying spree. After I finish this post, I plan on transferring a decent chunk of this into VTSAX and maybe a little bit into bitcoin for the funzies.

Brokerage: $243,977 (+$7,681)

The brokerage account outperformed the market, earning about 3.2% on the month compared to 2.7% for the SP&500.

While I’d love to say that’s because of my stock picking genius, unfortunately stock trading is for suckers. So this is just a matter of having a slightly different composition of index funds.

401(k): $250,241 (+$9,607)

It’s crazy to see the continuous effect of maxing out your 401(k).

This month saw another $2,200 automatically invested through my personal contributions and employer matching, and the lump sum behind those contributions is starting to build some serious momentum.

Those contributions are still broken down as:

- 50% S&P 500 Index Fund

- 30% Small Cap Stocks Index Fund

- 20% International Stocks Index Fund

Roth IRA: $60,970 (+$396)

The Roth holding strong at barely above $60,000.

The portfolio itself is still about 75% VGSLX and 25% VTIAX.

I talk about why I like VTIAX more than VFWAX here.

Rent Payable: $1,604 (+$839)

Like a true deadbeat boyfriend, I forgot to pay Lady Money Wizard her rent last month. So this is actually two month’s worth of rent. Thankfully, she hasn’t kicked me out yet.

On another housing-related note, stay tuned for next week’s article. By popular demand, I’ll explain why I don’t include the house in my net worth.

Credit Cards Payable: $2,310 ($1,775)

Glad to see the credit card down to a more reasonable amount this month.

For newer readers, I never, ever, pay credit card interest. If you have credit card debt, that’s one of the first places you should invest your money.

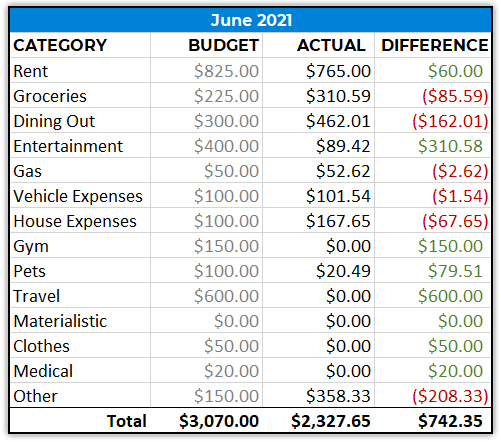

Total June Spending: $2,328

Wow, way under budget again this month, which surprised me. I guess those old quarantine habits die hard…

Dining Out: $462

Pretty much all the damage was done in just two $150 meals. But hey, they were delicious, and in these days of ultra-low spending, I’m not too worried about it. You can drive yourself crazy scrutinizing the details; sometimes it’s best to take a step back and look at the big picture.

House Expenses: $167

We went a little wild on the garden in June, picking up all sorts of new plants, bark mulch, and even bird feeders. At this point our backyard is doing a pretty good job impersonating a National Forest, so we’re probably set for the season.

Other: $358

I bought some gifts for friends, which oddly has become one of my favorite ways to spend money these days.

Gag you with a spoon right? But it’s the truth, I swear!

How was your June?

And more importantly, how was your first half of the year!?

Hope you’re doing great!

PS – If you’re serious about tracking your net worth, here’s my favorite tool to do so.

Related articles:

Congrats on a good June! And thanks for being honest about your month. Life is like your June for most folks, most months. Instagram really distorts that, because once you know enough people it’s hard to avoid someone else’s fun. This is also why I haven’t posted or used Instagram much in years!

I’m convinced that Bobby Boucher’s mom was wrong. Football isn’t the devil – Instagram is. Such an unhealthy platform, IMO…

Would love to hear your thoughts on combining finances when you figure all that out!!

Yep, definitely one of those grown up topics I’ll be researching.

Wow! The surge at the end is huge! Congrats.

I’m just chugging along slowly. Very unexciting really. And now on sabbatical for a couple months!

Sam

Nice, enjoy your well-deserved sabbatical, Sam!

Good job money wiz! Thanks for the inspiration. I started reading your blog 2 years ago and just surpassed $500K this month for the first time, and hopefully the only time. Appreciate all the wisdom, wiz!

Awesome! You’re crushing it! Strap in for compound interest!

I was about to send you a question regarding including/excluding your home, car, or other assets in your net worth – glad to see you will be addressing this!

Yep, stay tuned next week!

Hey Money Wiz,

What are your thoughts on investing in gold/precious metals/commodities as an inflation hedge with inflation on the rise?

Great post as always!

I like the gold.

You’ll notice I’ve increased my commodities portfolio from 0% to 1.6% in the past few months. I view it as an emergency fund with some hedge against inflation / other horrible disasters.

https://mymoneywizard.com/how-to-buy-physical-gold-bullion/

Wizard,

You might want to add a little gold or silver to that portfolio if you are concerned with inflation. Not a lot but maybe 3-5%. Just a thought.

It’s in the commodities section of the brokerage account.

I enjoyed the update as it’s fun to see someone cruising along and having it go well. My wife and I also are doing fine this first half of 2021.

Appreciate the feedback. Glad to hear you’re doing fine!

Congratulations. Reaching your goal has been accelerated by the bull market. So if this trend continues and you reach $1M and then are able to retire, how do you account for the a market that could easily go south, maybe extremely so? Pull back on your stock allocation once you reach $1M. What’s the plan once you reach $1M? Have you already blogged about this? Once out of stocks, the return on $1M is not what it used to be:(

As of now, the most realistic plan is to live off other income sources for the first few years, whether that be a hobby job, blogging, freelance writing, etc. If I can avoid touching the principal, or even just reduce how much of the principal I use to live, then what the market does on a short term basis is pretty irrelevant and should have me reaching old age with a ton of money. I write about this strategy here:

https://mymoneywizard.com/retire-age-35-4-million-net-worth/

Congratulations on a GREAT month, wow. Compound interest truly is a wonderful thing and can’t imagine how much further it’ll take you in just a single year.

Love these monthly updates!

Thanks, David!

Just finished your “savings explosion” article and I’m wondering if the max 401k contribution is 1$9,000 and IRA is $6,000, where do you invest the remaining $5,000 if one is able to put aside $30,000 this year?.

PS just got my first salary, engineering job and can’t wait to start my own savings explosion. Thanks for all the hard work and tips Sean!

Nice!

The rest goes into after tax accounts, aka the “brokerage account” in these updates. (Which mostly consists of VTSAX)

Hey Money Wizard,

Congratulations to another great month and thanks for a super entertaining blog – I enjoy every single edition!

After your last posts about investments and inflation, I am wondering how Lady Money Wizard manages her finances (or what your recommendation is)? I’m aiming for financial independence in about 10 years and am wondering if it’s smarter to pay off the mortgage of your home or if you would rather keep the mortgage (and maybe fix the interest at a low rate) and take your cash and invest it in your 3 fund portfolio? 🙂

Curious to hear your thoughts!

This is worthy of a full post, but in general you benefit from having debt in an inflationary environment. As prices rise yet your mortgage stays the same, your mortgage is costing you less and less. Imagine paying a mortgage from 1970. Inflation has made that payment laughably small.

Plus just think it through – say gas, food, and the stock market are all increasing at 10-20% but your mortgage is only 4%. It makes more sense to use extra money to buy stuff increasing by 10-20% a year rather than 4%.

Thank you for your super quick reply! 🙂

That makes sense of course! It always seems to be the safer bet to reduce fixed costs first and then put cash to work elsewhere, but you’re right, in an inflationary environment that might not be the best choice!

What do you use for your brokerage account? I have vanguard for my Roth IRA and Fidelity for my 401k. After I open my hsa later this year I’m going to work on the brokerage.

Hey, congratulations on your net worth! Awesome Job! My husband and I married when I was 19 he was 23 and we combined everything pretty much. I have worked off and on during our marriage (he’s military so we move around a lot) and it just makes things easier. We work more as a team seems like a lot of people who keep finances separate act as roommates and then argue about the fairness of who pays more of the bills based on income. Not us…we come up with a budget together but I’ve paid all the bills our entire marriage just because it makes things easier. My husband left for Iraq soon after we married and I was in charge of the finances things haven’t changed 13 years later. Just remember a marriage is a team when you say I do you are now one.

Thanks, Jen!

Hi Sean,

Good work. I have a quick question. Are you happy with Vangaurds’s VTSAX, I am thinking of opening up 2 IRA’s. husband does max out his 401k. Do you recommend VTSAX as an ETF or regular. I do have some stocks already with Vanguard. I would like to contribute to IRA’s and Vanguard Brokerage account. Thank you so much for your help. Enjoy the rest of your summer.

Yes, I really like VTSAX. Personally I prefer the mutual fund vs. the ETF for reasons I explain in this article:

https://mymoneywizard.com/how-to-decide-between-an-etf-or-mutual-fund/