Thanksgiving is the best holiday. By far.

Thanksgiving is the best holiday. By far.

Come at me, Christmas.

To be fair, since nobody actually cares about half of the other holidays, that makes the competition slim in a hurry.

Sure, scoring a day off work for Labor day is cool and all, but does anyone really look back with nostalgia at the power of trade unions and their impacts on the 1880s Labor Movement?

Which really only leaves the big guns. Christmas does have the bright lights, and boy… do I love me some good Christmas lights. But Christmas is also held hostage by advertising and consumerism, which walks people down the plank to guilt stricken gift giving.

And while they’ve recently tried to infringe upon Thanksgiving’s wholesome image by opening the Black Friday floodgates after dinner, everyone knows they still can’t touch this.

No matter how hard they try, people view Walmart’s 6:00 PM Thanksgiving night opening with disgust, because they know what the holiday is really about, and it’s just three things:

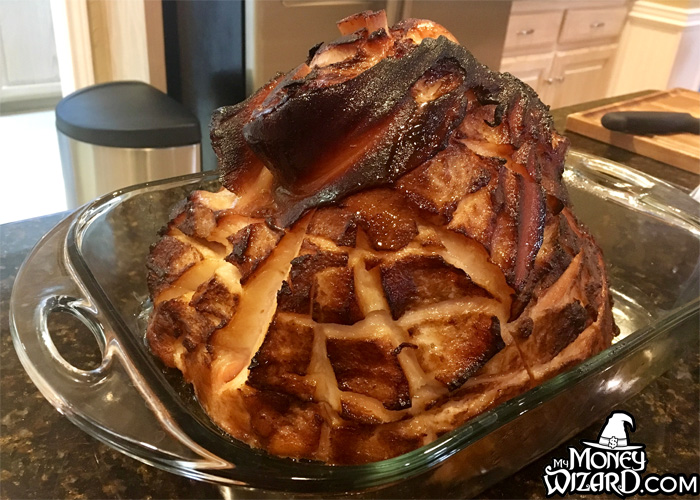

Friends, family, and delicious homemade food.

I was thankful for all three this November. In Minnesota, I had my pre-thanksgiving Thanksgiving, then used some travel points to book a flight down to Texas for the big show.

As a native Texan living in Minnesota, I’ve got that sort of inter-state expat thing going on, and it makes the precious time with family that much sweeter.

Other November news included using The Cash Cat as my proxy to vote in the local elections:

AND MOVING INTO A NEW HOUSE.

?

The early part of the month was packed with oh… about 9 million trips back and forth between the apartment and the new house. It was a humbling reminder that even when you’re extra cautious about buying stuff, the accumulation is real.

In preparation for the move, we Craigslisted, donated, and trashed our stuff with the fury of a Buddhist Monk. And amazingly, as I write this, there’s still pile after pile of stuff sitting in our basement, just waiting for a spring garage sale.

But on the whole, I’ve loved the house so far.

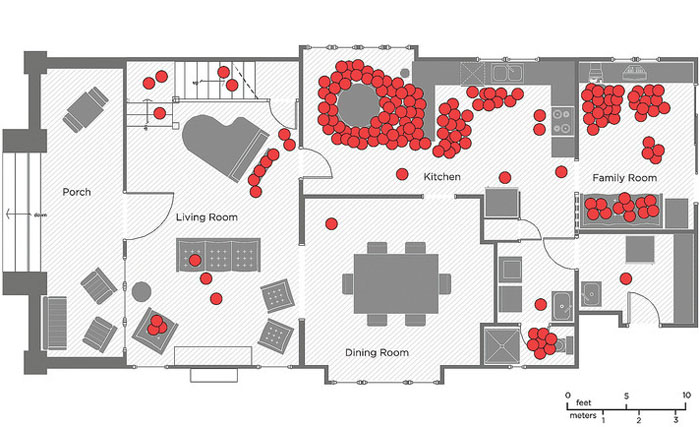

At 1,200 square feet, we’re both glad we stuck to our guns on the sizing. It’s just big enough that we don’t feel weird about inviting people over or having guests use the extra bedroom, while being small enough that the day to day movement doesn’t turn into the mile long hikes found in million dollar homes.

Plus, there’s the miniscule mortgage payment, which should help keep me saving like a maniac towards financial freedom.

And besides, there’s no sense in spending more, when studies show I wouldn’t use the extra space anyway.

On the last day of November, we celebrated a successful month in the new place by setting up our first Christmas decorations. Hey, I told you I love the bright Christmas lights!

Net Worth Update: November 2017

Holy stock market increases…

And the detailed breakdown:

To the details!

Cash: $8,296 (-$2,947)

Hey look, I’m finally putting my cash to use! After months of holding enough cash to make me hypocritical of my views on emergency funds, I finally started putting up or shutting up.

My cash on hand dropped by $2,750 when I finally made a contribution to my Roth IRA this year. Then it dropped another $200 (despite paychecks coming in) because I spent a S#!T-ton of money this month. But we’ll get to that in a minute…

Aside from being an embarrassing hypocrite, the bigger reason for me holding so much cash was that I was living in a dream world where I’d be able to save up enough money to buy an investment property before the April 2017 Roth IRA deadline.

Then, earlier this month, I had a brief moment of clarity. It went something like this.

- The Money Wizard: “Wait, what??? It’s November already??”

- The Money Wizard’s brain: “Well obviously.”

- The Money Wizard: “There’s no way I’m going to save $20-30,000 more dollars by April. What on earth am I thinking??”

- The Money Wizard’s brain: “No clue. Time to rip off that band-aid, and max out your $5,500 of Roth contributions for 2017.”

And that’s my plan. I want to have a fresh start to 2018, so I contributed $2,750 to my Roth in November, and I’ll contribute the last $2,750 in December.

Then, instead of playing catch up next year for 2017 contributions, I’ll be off to the races towards my eventual investment property.

Brokerage: $109,098 (+$3,262)

This market is just never ending. It seems like every week Personal Capital sends me an email to let me know what a ridiculous return my investments have made, without me doing a thing.

Earlier this week the Dow market topped 24,000 for the first time in history. Obviously, this is good news for somebody holding 6 figures of market investments.

My breakdown remains:

- $54,500 invested with Vanguard’s Total Stock Market Index Fund (Related: How to Choose a Vanguard Index Fund)

- $33,000 invested in a mixture of Vanguard growth, value, and bond ETFs.

- About $20,000 of individual stocks back from the days when I thought I could beat the market. I’ve now wised up and decided not to trade individual stocks.

401(k): $81,843 (+$4,430)

The rapidly rising market helped here too, and so did the fact I’m contributing a HUGE portion of my paychecks to my 401(k) through the end of the year.

Man, it’s going to be so nice to hit the ground running on my 2018 contributions.

I’m still playing catch up after a few months earlier this year, when I only contributed enough to get my company match. (I wanted to kill that car loan before paying a cent of interest. I succeeded, but I’ve had to contribute a massive amount of my paycheck since, in order to max out my 2017 tax benefits.) It’s been a bit of a cash drain, to say the least.

PS – if your company is like mine, the time to start contributing for 2018 contributions is actually in the first or second week of December, since those paychecks don’t get paid out until the new year. Check with your HR!

And don’t forget, the IRS says we can contribute an extra $500 in 2018!

Roth IRA: $21,502 (+$3,240)

You all… I FINALLY did it! I made a contribution to my Roth IRA this year.

And it feels GOOD! So good, that I’ll contribute another $2,750 in December.

The whole Roth is still invested in Vanguard’s REIT Index fund. I may re-evaluate this allocation soon, but for now, it still seems to work.

Despite the girlfriend and I just closing on the house, I still don’t technically have any real estate in my name. So for diversification’s sake, holding $21K of REITs seems like a nice addition to the portfolio.

Rent (Mortgage??) Payable: $758 (+$43)

With the home inspection noting a new $6,000 roof in our future, a slowly dying water heater, and who knows what other surprises of home ownership, Lady Money Wizard and I decided to just keep pretending our monthly rent is $1,300, even though our mortgage is only $680. We’ll put the $620 difference into a high yield saving’s account for now.

So, why the $43 increase? I forgot we’d be paying for utilities for two places at once, because of the move.

Credit Cards Payable: $2,484 (-$1,235)

A decline from last month’s huge bill, but still a little more than I’d like. Here’s the detailed spending breakdown:

Total November Spending: $2,731

Ouch. Not a good month.

To be completely honest, this might be the first Net Worth Update that I’ve been embarrassed to post. Mostly because of one category:

Dining Out: $422.23

What. The. Hell.

Obviously, I fell off the wagon hard in November. I could probably write a whole Go Figure article on this month’s meal spending alone, but it amounts to dining out 23 times in November. That’s almost once per day!

Is this what rock bottom looks like?

I could make up a million excuses for this. I could write about how busy I was with the move, how the new place’s lack of a dishwasher makes take-out all the more appealing, or any number of other weak explanations.

But the point is, I blew some serious cash! And I’m determined to get this under control next month.

Other major line items:

- Rent: $390

- I forgot we’d only be on the hook for about half a month’s rent in November, which was a nice surprise.

- Gas: $53.99

- The Mazda 3 averages nearly 40 mpg, but the trillion moving trips back and forth had me blowing the budget slightly.

- Travel: $0

- Hooray travel points! I avoided the outrageous thanksgiving flight prices by using leftovers from that Chase Sapphire Reserve promotion. I <3 free trips.

- Vehicle Expenses: $317

- $77 of car insurance. Plus, $240 for annual vehicle registration, since (bitter frugal blogger warning!) the 7% Minnesota state income tax last year somehow wasn’t enough.

- Apartment (home?) Expenses: $1,063

- Should probably rename this section. This included $45 for quarterly trash service, $280 of prepaid home insurance, a $140 sink repair, $80 for a new dresser and bed sheets, $260 to movers, and $160 to a maid. (worst frugal blogger ever.) Hoping this category dies down a bit, now that we’re settled in. We’ll see!

Pretty crazy that in all the wild spending, my net worth still had such a huge increase. If that’s not motivation to keep investing into productive assets, I don’t know what is.

By the way, if you’re not already tracking your own spending, I can say from experience it’s probably the easiest way to take control of your money. I highly recommend Personal Capital, which will track everything for you automatically. If you prefer to be a little more OCD, you can always track it manually using this underrated iPhone app.

Readers, how was your November?

Related articles:

Hi there Money Wizard! Thanks for another great update. I’ve started to really look forward to these. It’s interesting how turkeys have made a guest appearance on your commute as well. This has started to happen to me as well. Makes me wonder, were turkeys this common during the time of the pilgrims? Is this why we have turkey on Thanksgiving?

Anyway, I thought this line was interesting “look back with nostalgia at the power of trade unions and their impacts on the 1880s Labor Movement?” I actually think that in some ways (obviously not all) we live in an era of labor relations reminiscent of the late 1800. The pendulum has swung quite far towards the corporate side. I think some day we might just reminisce about what trade unions did for us.

Who do you recommend for a high yield saving’s account?

Ally is who I have in mind. They have online savings accounts at 1.25%.

Solid month when it comes to net worth increase. Not great to see that you went over the monthly budget but that happens. As you stated, maybe in Dec do not eat out as much. 🙂

Im using the Spendee app and it works great. Check it out when you have some time.

Quick question on your net asset position. Why don’t you include your car as part of your net worth? I have a car loan in my Personal capital and included the car as well as I wouldn’t have one without the other.

Any particular reason it is excluded?

Love your posts!

Technically it’s a depreciating asset, but I just don’t see the point in including it.

I plan on driving it into the ground, so it seems a little silly to give myself ~$13,000 of assets when I know I’ll never sell it for more than scrap metal. If the goal of these updates is to show my progress towards retirement, there’s no sense in padding the numbers.

I also think of it this way… I could liquidate all $217K of my assets tomorrow and buy a Ferrari in cash. Using the “car is an asset” accounting would show my net worth didn’t change at all, but in reality, we all know I’d be in A LOT worse shape financially.

I definitely see that rationale. I am depreciating the car on Personal Capital just by simply applying a standard rate. Since I have the car loan set up as a liability, I have that and the car in place. While it’s not something applicable to “retirement” net worth, I definitely see it as a valuable asset at the moment (that will depreciate over time along with my car loan). Both will eventually go down to zero, so your point is reasonable I suppose!

Thanksgiving used to be my favorite holiday until the Christmas shopping season encroached on it. I think I will throw my vote to Labor Day. Who doesn’t need a day off to rest up from working?

My wife and I lived in a 1200 sq ft house for 20 years. It was a little small, but very functional. Living in a 2400 sq ft beast now, I kind of miss the little one. I actually think 1500-1800 sq ft would be just right.

Thanks for the post. Nice November and best wishes for December! Tom

I feel you on the eating out. It catches up to you. I recently moved to Toronto from Calgary and spent over 500 eating out last month. Toronto is such a good food city, its hard not to! But this month i have gotten things under control so far and will do my best to keep it up.

You add the miscellaneous moving/furniture expenses and this last half of the year is brutal for my finances. At least i have a new job and decent raise. Come January I should be back to my regular spending.

I threw $5,500 into my Roth IRA as well in November. Feels good, but haven’t deployed it yet into the market… not sure what to invest it in.

Thanks for sharing. Finish strong in December!

Nice net worth increase Money Wizard! But holy hell $422.23 on eating out? Whew!

And what’s this about a maid? You don’t cook or clean anymore?

Haha, I know…

shame. Shame. SHAME!

I introduced the maid back in the June Update. My comments then sum up my thoughts now:

“Yep, that’s a maid. Go ahead and banish me now, frugal bloggers. In the interest of matrimonial harmony, I’ve hired someone to clean my place top to bottom. It’s a ridiculously lazy expense, but hey… compromise. And I do have to say, I’ve never seen a bathroom so clean. ?”

If I don’t get the eating out expense under control this December, then please… beat me over the head with my restaurant bills.

Thanks for the inspiration to finally put more 2017 money in a Roth IRA! I put some in during the early part of the summer, and then did nothing more. Today I put another $1000 in! I probably won’t get to the max out, but I am closer than I was before! 🙂 As the age clock ticks past 30, it seems more important than ever to try to get money in and let it cook for a full 30 or so years.

Awesome to hear! Also, even if you don’t max it out before the year end, tax rules actually give you through April 2018 to make 2017 Roth contributions.

What exactly do you have invested in your 401k through your employer? Do you just put your money in a basic target date fund or do you have it allocated differently in Small Cap, Large cap, Bonds, etc.? Really enjoy your articles they are very informative!

Very funny you found a family of turkeys on the road. Thanks for sharing your story.