We’ve all heard of the 80/20 rule right?

It’s sometimes more fancily referred to as The Pareto Principle after Italian economist Vilfredo Pareto, who calculated 80% of the land in Italy was owned by 20% of the population.

Of course, some business management consultants took the idea and ran with it, pitching the idea that 80% of sales come from just 20% of clients. (No doubt 80% of the consultant’s overpriced fee was from just 20% of their work.)

But those overpaid consultants may have been onto something.

Because the interesting part, as it turns out, is that the 80/20 rule seems to be more than some business mumbo-jumbo. More shockingly, The Pareto principal seems to hold as both a mathematical and universal truth.

Why the 80/20 Rule Matters for Your Money

Once you become aware of it, you’re like Jim Carey in that cheesy movie The Number 23; you start seeing the 80/20 pattern everywhere:

- Pareto was inspired to research the rule when he noticed 20% of the pea pods in his garden provided 80% of all peas.

- 80% of the world’s wealth is held by approximately 20% of the world’s population. (And similarly, that 20% pays 80% of all taxes)

- Microsoft found that by fixing the top 20% most reported bugs, they eliminated 80% of software crashes.

- Hardcore stat nerds calculated that 20% of baseball’s best players account for 80% of total wins.

- The frequency of words used in most languages, the size of cities, the magnitude of earthquakes, the intensity of solar flares, and even the size of moon craters all follow similar Pareto distributions.

Safe to say, if the rule applies to everything from taxes to earthquakes, it probably applies to our personal finances too.

So, the question this money blogger wants to know: What’s the 20% of stuff making up 80% of our spending?

Because if we can highlight those important areas, we can unlock the key to saving a fortune. WITHOUT constantly stressing about every tiny detail of a budget.

Breaking Down the Average Person’s Budget

It turns out, every year the Bureau of Labor Statistics runs the world’s most comprehensive study on average consumer spending. But like any good government agency, they’re a couple years behind, so their most recent study is from 2016.

Also like any good government agency, they’ve presented their findings in the most eye drying formatting you’ve ever seen. So, I’ve deciphered their mind numbing text to create this nifty chart:

Whoa!

Of the hundreds of items we spend our money on throughout the year, just three things account for exactly 70% of our annual spending. Not quite a perfect 80/20 rule, but pretty darn close.

(Note that for some reason, the BLS includes social security taxes as consumer spending. Since avoiding your social security taxes is the quickest way to a prison cell, I’m not sure this is something consumers really have any control over. Including this really skews our numbers, so I’ve removed that “spending” in the table and adjusted the totals accordingly.)

The Big Three – The Key to Saving Tons of Cash

As we can see from the chart, the average American has the atrocious savings rate of just 4%. This means it will take the average person 25 years just to save just 1 year’s worth of their spending.

Put another way, if they’re not investing their money, they’d have to work for 600 years to fund even an average length retirement. If they’re a savvy index fund investor, they’re still looking at somewhere between 55 and 61 years before they build up a portfolio capable of safely supporting their retirement.

Obviously, this is a huge problem. The main culprit? The Big Three – housing, cars, and food.

1) Housing

Weighing in at a whopping 37% of the average annual budget, housing is a heavyweight villain in the spending category. And if you’re not careful, that big bastard will knock your savings out cold.

Conventional wisdom complains that this cost is mostly out of our control, and we should instead surrender to the market forces of wherever we happen to live.

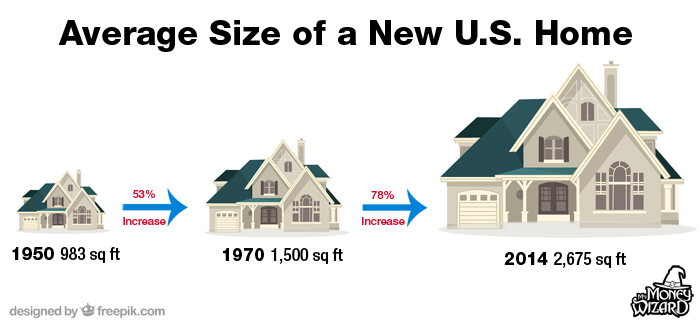

Of course, Money Wizards know that’s mostly nonsense. It’s not mysterious market forces which caused the average home size to increase from 983 square feet to nearly 3,000 square feet since 1950. Nor can market forces hide the fact that despite this increase, 68% of a typical house still goes entirely unused.

But good news! While the rest of your local market might be subject to this mania, keeping your cool represents a HUGE opportunity for savings.

If you’re renting, ask yourself whether stainless steel appliances will actually improve your life in any meaningful way. And if you’re buying, take a long hard look at how much space you really need, and whether a mega huge yard with its mega huge maintenance is really something you want in your life.

And if all else fails, you can always look for a cheaper city. Denver’s out of control home prices were certainly something I considered when I decided to pack up shop and head north to Minneapolis.

2) Transportation

We’ve got a pretty sad state of affairs when the average person spends over 4 times more on their cars than their personal savings.

And yet the numbers don’t lie. Transportation makes up 18% of the average budget, at over $9,000 of vehicle related spending per year.

The great news? Vehicle spending is far and away the easiest category to control. With today’s vehicles easily lasting 100,000 miles, and some reliable brands often hitting 250,000 miles with basic maintenance, saving money on your cars has truly become a cakewalk. Or cake-ride?

Saving money on your second biggest expense is as simple as remembering to love your old car. Each month old faithful sticks around, she might as well be writing you a $500 check (the average price of a new car payment these days).

And when you can no longer avoid old faithful’s knocking, sputtering, and stalling any longer, taking a reasonable approach towards the new car upgrade is key towards keeping your saving under control.

I bought my new Mazda 3 for $13,000 – nearly 1/3 the cost of the typical new car price. And by saving up to pay the whole thing off before I paid a cent of interest, I completely nuked one of the biggest recurring expenses in the average budget.

But the savings don’t have to stop there. The IRS estimates that driving costs 54.5 cents per mile. With the average worker rocking a morning commute of ~15 miles, that’s a Chipotle burrito each way!

No doubt, being smart with where and how you drive can save hundreds on gas, oil changes, and maintenance.

And for the truly dedicated, public transportation is a nearly free option, with the added benefit of freeing yourself to become productive during your commute. Biking to work is also free, and doesn’t take as long as you think, especially when you factor in the efficiency of exercising while commuting. (No need to slog yourself to the gym when you’ve already pedaled 20 miles round trip today.)

3) Food

The average consumer is rocking a $600 a month food bill – a full 50% increase from my own personal (and admittedly out of control) food spending.

I struggle with this one myself, but I’ve come to notice a few patterns.

Restaurant spending is the obvious killer here. A couple of fancy dinners with a habit of lunches out can wreak havoc on a food budget.

Contrary to popular belief though, eating healthy is a misplaced scapegoat. Fruits and veggies cost pennies, and even meat is reasonably priced when mixed with a dose of healthy sides.

But chips, cookies, snacks, and junkfood? Crazy pricey.

Another key is avoiding “gourmet” grocery stores like Whole Paycheck. $6 for a bag of grapes? No thanks.

I’m a huge fan of Aldi, whose ultra-lean operating structure allows them to be even cheaper than Costco for many items. Here’s how I spend less than $35 a week on groceries.

Conclusion – Use The Pareto Principle to Save Serious Cash

Pareto proved that focusing on a few important factors can create oversized changes for the big picture. So, if you want to save over half your income, the majority of the answer is right there in front of you.

I saved well over half my income last year, and there’s no doubt that 80% of that heavy lifting came from a small minority of my budget. My lack of a car payment, my cheap house, and my watchful eye on food spending were the items I worked most to reduce. Meanwhile, my carefree spending on smaller (and more fun) categories, like travel and entertainment, couldn’t even make a dent.

If you want to do the same, forget stressing about the small details. Go to happy hour with your friends, and take that much deserved vacation. But focus on just The Big Three – Housing, Cars, and Food – and you’ll still save a fortune.

Pareto would be proud.

PS – Want to start tracking your expenses like a boss? I still love Personal Capital. It’ll automatically tally up all your monthly spending, so you know exactly how much you’re spending on what.

Related Articles:

Well said Wizard. A lot of people stress over their finances and try to save pennies here and there. Yet they seem to completely forget, or maybe purposely overlook, the big 3 in their calculations. Many see those 3 expenses as “the cost of living” and those can’t be changed. Especially housing and transport.

Instead, people should grab these three by the roots and make a change that has an effect once and for all. It’s impact is way bigger than saving a few bucks on coupons.

Couldn’t agree more. Grab it by the root!

Totally agree with you. Plus a smaller house means much smaller utility bills.

Great point. A couple extra square feet really adds up.

The first time I heard of the 80/20 rule was when I started a job and my boss said “The 80/20 rule definitely applies in that 20% of the people here do 80% of the work.” He wasn’t wrong.

I got after my big 3 expenses as best I could in the last couple of years. I even changed jobs to lower the transportation costs. Both in terms of time spent commuting and money spent, going from 29 miles commuting to 9. The food budget is still the one I have the toughest time with because I could very easily bring it down. Luckily my housing costs are 16.88% of my yearly income, so overall I am still budgeted at only 51.19% of my yearly income being spent.

Ha, definitely true about any place of employment, I think.

So awesome to hear about your progress, and really impressive that you had the courage to take the big steps you did. Sounds like the proof is in the savings rate!

This is so true MoneyWiz! Nailing just a few categories can have a huge impact.

During our saving years, we easily saved around 70%. We didn’t live in large fancy houses, didn’t drive fancy expensive cars, and cooked most of our own food.

So yeah, it works.

That’s an awesome savings rate. I’ll miss that this year because of the kitchen remodel, but it will be fun to see how high I can get next year. 70% is my goal.

I needed this reminder today – thank you! My big expenses are on autopilot: apartment, walking for transit and TRYING to keep my food budget low – I know you feel my pain on that one 🙂 . I was beating myself up after seeing my H2 expenses because they were a little higher than I wanted, but then I calculated that I might be 2% over my target budget at the end of the year and to get it down I’d have to cut out things I actually enjoy (camping, bringing wine to friends’ houses etc) to decrease that little bit. I decided it wasn’t worth it. I have the big expenses as low as I’m comfortable with so I’m not sweating it anymore.

Sounds like you’re doing a great job! Hope you found the reminder encouraging!

Excellent post.

I do believe there is money to be saved in the little details, but I agree these three main expenses are the big killers for most people. Personally, I’m ashamed to admit that I spent more on food in July than I did on my half of the mortgage payment. Doing good on the housing front, doing terribly on the food front.

The good news is the food thing is the easiest one to change. Here’s to a more frugal August.

Hey, glass half full. Maybe you didn’t spend a lot on food; maybe you just spent very little on housing! 😉

Great post, I’m 24 years old and transitioning out of the Military.

If you have time to chat, I have a few questions to ask you over email.

It will be my first time living on my own in the states.

Who the hell makes 80k, especially at 28!? Median income is mid 40k! Go suck a lemon!

Usually people who strategically choose their degree.

I’m more of a lime guy.

Excellent article.

One thing worth noting is: relocation is not always an option. It depends much on your profession and your other priorities in life.

Take my hometown Brooklyn, New York for an example. The median household income is $44,850, while the median house price is $791,300. Even if you work in Manhattan and ride the typical 1-2 hour (each way) daily commute, the median household income over there is still only $66,739. An average apartment in Brooklyn, NY is 724 sq. ft. for $2,649 per month. An average studio is 470 sq. ft. for $2,205 per month. Neither is ample space for 1 or 2 persons.

The average annual auto premium for Brooklyn is $3,550.47. I’d not delve into vehicle prices. You can refer to the parking rates published by nyc.gov. I’m trying to say, just the auto insurance alone is $300. For a millennial, you are unlikely to get much discount, so yours will be in the $450+ range. If you use street parking, you are likely to spend 20+ minutes fighting against a dozen other people for the same parking space daily. The good new is, a 30-day subway pass costs $121, which is far cheaper than owning a car, and most homes and work places are accessible by public transportation.

When it comes down to food, a worth-noting thing is that New York imposes a 8.875% sales taxes on certain food categories, including bottled beverages (including bottled water) and candies. NYC food tax guide: https://www.tax.ny.gov/pubs_and_bulls/tg_bulletins/st/food_sold_by_food_stores.htm. As for pricing, food is not expensive comparing to other costs, but still above national average. A good reference article is here: https://www.expatistan.com/cost-of-living/new-york-city.

If you are a millennial, your starting annual gross income is likely to fall within the range of $30-80k. That’s a take-home-pay (without contributions to healthcare, 401k, and spending accounts) of $23,440-54,037. That would mean buying a home is impossible, and rent sharing is not an option (note that a 470 sq. ft. studio costs $26,460 annually plus some $720-2000 for utilities, which is greater than the take-home-pay of a $30k job). Owning a car and driving are going to be unaffordable. Your only “luxury” is food, which still hits you with a 8.875% sales tax if you buy anything ready-to-eat, including a cold, factory-manufactured sandwich and a bottle of water. For an average millennial, it’s unlikely to make enough to cover the minimal cost of living, frugal living is not an option, and saving money would mean sacrificing the most basic living quality. Another worth-noting thing is, Brooklyn doesn’t have many local jobs that pay more than $40k a year. You probably have to commute to Manhattan to work. And for a city of over 10 million people, while the job posting list in here may seem longer than most cities, in reality you do have to compete against some other hundreds of people for a mediocre job that doesn’t pay more than the same job in elsewhere, and long hours and high work intensity are expected.

On the other hand, for jobs and for family, it’s not always easy to move out of this place. Certain professions, such as entertainment and financial services, do have stronger affinity to higher-cost localities. Most companies and most jobs do not offer a working-from-home option. While no one wants to work hard for long hours to barely make enough pay their share of a tiny apartment’s rent, they might or might not have a job elsewhere, or they might have to move for every job, which creates a hassle for those with a family. Your family is not just you or and and your spouse. You have kids (eventually). You have siblings and parents. You have friends and business connections. Those are not always trivial to replace. The other possible reason is, you have to burn through your pocket to pay for the basic cost of living, have no savings to explore elsewhere, and no cheap place to store your belongings without working full-time. Your parents are likely to work over 67 to repay mortgage or they are likely renters who share apartment with you. Your departure could mean no-return to your parents’ home because they’d have to sublease your previous space to someone else to cover the rent or mortgage. Zero savings and no home to return would mean greater risk to try things out elsewhere. And for the elderly, while the cost of living is upsetting, the convenience of city life is hard to replace, especially for the proximity to healthcare. My parents refused to move out after retirement, solely because they have become too old to drive and too sick to stay away from the doctor. If you are a millennial with elderly parents who have already paid off their mortgage or have rent control protection, you are probably still better off staying with them, even if that means you’d have to work harder and have no savings. And if you happen to have some millionaire friends or relatives around, the business connection is also a valuable asset. Besides, who doesn’t love their parents? And who doesn’t miss their friends?

Those are my thoughts on this topic. Thanks for putting up such a comprehensive article and thanks for reading my comments. Have fun!

I enjoyed reading your article. But what you didn’t factor in is that moat millennials have chunks of student loans and potentially single. How did you factor in paying off your staudent loan if you had one with saving that much. And how long did it take you to save that much. Also does your Work give end of year bonuses which most companies don’t offer anymore? Thanks.

Congrats on your CNBC feature. The big three expenses control most of the budget, but I always add “The Next Two” tend to be travel expenses and investment fees for the average consumer. Both of these can be driven low quickly through switching to low cost index funds and utilizing credit card rewards.

Cocoa, no student loan debt for this guy thanks to his parents and pay as you go. Also, he banked all his raises didn’t alter lifestyle.

I had to laugh when reading the above article! The three big expenses of life: 1, housing; 2, food, and 3, transportation! I am a 73 year old woman, former teacher, now retired. I agree with the first two, but my third one was clothing! My thought? Only a man would list transportation ahead of clothes! But seriously, I love my car and don’t know what to do without one!!!

Chris

CNBC article says you have an $80K salary and can save 60% of it.

Doesn’t seem possible. Taxes, SSI and Medicare will easily take 20%.

So that would leave 20% for all of your other expenses.

$16K/year or approx $1400/month.

Mortgage, insurance (car and home), food, utilities seem like it would cost more than that unless you are in a very low cost area.

I save 60% of my take home pay.

Take home pay is around $55K.

Spending is around $22-24K.

Plus ~$14K of retirement contributions + employer matching, which I count as both income and savings.

Equals $45-47,000 of savings a year or a 56-61% savings rate.

I break down my spending every month in the net worth updates.

A well-reasoned and data-driven post. I particularly appreciate the excellent use of links supporting your main points. Loved the dry humor regarding government agencies!

Buying a house you can afford is critical. Closely examining loan amortization calculator results and understanding the hidden costs of both loan interest and the opportunity cost of that interest prior to making an offer on a home is one of the best things someone can do when house shopping.

Beyond never buying a vehicle on credit, my wife and I further reduce our transportation costs by purchasing makes and models with proven reliability and fuel economy, performing our own DIY maintenance and repairs, consolidating trips, and practicing the art of hypermiling. Mazda 3’s came up repeatedly in our search for a reliable and fuel efficient hatchback a few years ago, but we ended up rolling with a Pontiac Vibe in the end.

We are huge advocates of Aldi for economical grocery shopping as well. Neat fact – did you know that Aldi and Trader Joe’s are simply two different divisions of the original Aldi? It’s a fascinating story dating back to Germany, post-WWII.

Pursuing aggressive goals like financial independence on just a median income meant my wife and I had to pay careful attention to all expenses (not just the Big 3), but these will definitely have the largest impact overall. I personally consider all taxes (including FICA taxes) as expenses in my own calculations, as I’ve found that not doing so removes the incentive to optimize one’s taxes. And while the options to reduce SS taxes are somewhat limited, both HSA and FSA contributions fit the bill.

Hello!

I had to laugh when reading the above article! The three big expenses of life: 1, housing; 2, food, and 3, transportation! I am a 73 year old woman, former teacher, now retired. I agree with the first two, but my third one was clothing! My thought? Only a man would list transportation ahead of clothes! But seriously, I love my car and don’t know what to do without one!!

I have to comment on the comment from Moon!! I’m right there with you!! 74 year old woman, former teacher, now retired. Only a man would count transportation as ahead of clothes!! But I have decided looks aren’t nearly as important as vital essentials of Life!! Housing and Food definitely have first place, but transportation?? Not nearly as important as one’s health!! If you don’t have it, you have very little!!! Snack foods, however, are non-essential!!! Destroys one’s health!!! Especially sugar!!!!!!

Just found your page today, this article is spot on. I think transport is where a majority of people could save a lot of money.