One of the most common complaints about investing your way to wealth is that it’s too long of a grind.

As the story goes, you have to scrimp and save your way for YEARS, supposedly ruining your life in the process, if you ever want to get rich without hitting the jackpot.

I only have two responses to that.

- Nope.

- Nope.

Here’s the truth most wealth “gurus” won’t tell you.

To be set for life, you really only need to save seriously for 3-4 years. (And you can do so on an average salary…)

Sounds crazy?

Sounds like a get rich quick scheme?

It’s not.

It’s just about generating what I call a “savings explosion.”

You only need one or two of these explosions to be truly set for life. From there, it’s just simple math dashed with a small dose of patience.

The Secret Power of a Savings Explosion

Think about it this way:

- The average person saves about 5% of their income each year.

- The average income is about $50,000 per year.

- Therefore, the average person saves about $2,500 per year.

If this is you, I hate to break the bad news. You might never reach a million bucks.

At average stock market returns, investing $2,500 per year ends a 40 year run with $534,000.

Nothing to sneeze at, sure, but in this case, the common complaint about building wealth being a slow, treacherous grind is absolutely true.

But it doesn’t have to be this way.

Now imagine you make some significant life adjustments. You opt for a cheaper place to rent or own, eat out less, or trade the overpriced car for something resembling a lovable beater. (The Big 3 Expenses are really the only ones that matter)

Maybe you even throw in a side hustle for good measure.

In any case, you go wild. You save like a madman. And FOR JUST ONE YEAR, you manage to save $35,000.

(A whopper of a number, but this is actually similar to the amount of money I was saving shortly after I got my first $50,000/year salary.)

Here’s the important part: If you were saving $2,500 a year and then somehow manage to save $35,000, then BOOM! You just saved 14 yeas of savings in a single year.

You just had a Savings Explosion.

This is how you generate serious wealth.

With a little bit of temporary sacrifice (which probably wasn’t that much of a sacrifice, anyway…) you just bought 14 years of freedom.

Or did you?

How one saving explosion can actually get you 1/3 of the way to retirement

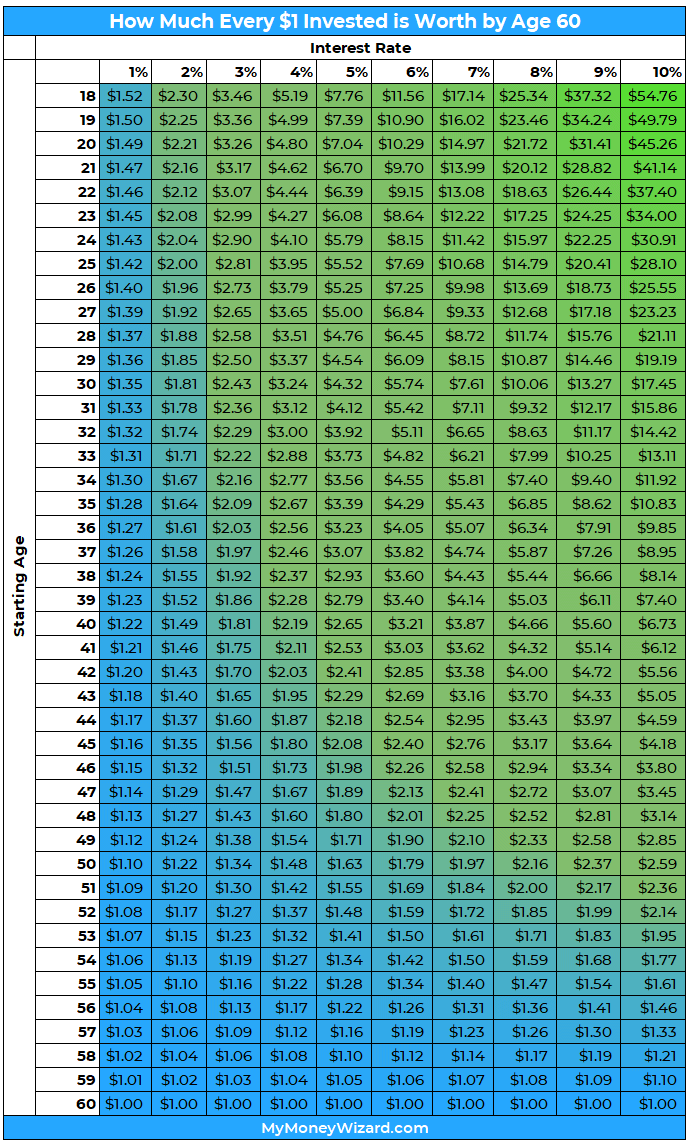

One of the more popular posts on this site is the chart I made showing how much every $1 you invest is worth at age 60:

Let’s run through our scenario again, remembering that each $1 you invest at age 25 is worth about $11 by age 60. ($10.68, assuming 7% returns)

That means one single $35,000 savings explosion at age 25 adds $373,800 to your portfolio by age 60!

By scraping together $35,000 early in life, you’re 37% of the way to a million bucks!

String three of these years together and you just built a $1,121,400 retirement portfolio.

Three years is nothing! Especially if you’re young.

In your mid-20s, you probably just spent the past four years living a vagrant lifestyle between college dorms and grungy apartments. From there, if you score a well paying job out of school (or even a below average one, supplemented with some side hustle effort) and just don’t go crazy with your spending, you could be set for life in less time than it took you to knock out your core credit hours.

After that, you’d never need to save another penny again, if you didn’t want to.

You could literally spend your days living it up, blowing through every dollar you earn, and working whatever dream job you’d like, so long as it put food on the table.

That sure doesn’t sound like a long grind to me…

How realistic is it to save $35,000 though?

Good question, and I’ll answer it with another question.

How badly do you want financial freedom?

I don’t know about you, but I want it pretty bad. Which is probably why I came out of the college gates swinging, saving anywhere from $20,000 to $30,000 per year.

Sure, I had a good paying job. (About $50,000 salaried) But it should also be noted that I wasn’t exactly setting frugality world records, either.

I rented my own apartment (didn’t even have roommates) and did quite a bit of traveling. I also barely earned a penny from side hustling – Uber, Upwork, and the gig economy barely even existed back then. (Does that make me a dinosaur? 😱)

There’s no doubt in my mind that anyone ambitious enough could sock away this wad of cash, pretty much no matter their income.

It should also be noted that $35,000 isn’t the magic cutoff, either.

You’re free to go at this challenge at your own pace. Say you “only” manage to save $15,000-$20,000, which is still awesome. You could still build a future million dollar portfolio in just 5-6 years.

From there, you can coast through life, doing pretty much whatever you want. You never have to stress about money ever again, because you know you already took care of the heavy lifting.

How amazing is that!?

Start a savings explosions now!

Really, the biggest advantage of all is simply starting early.

Interestingly, that advantage of time can also override just about any earnings advantage and/or disadvantage.

And here’s the best news. Today is the oldest you’ve ever been, but it’s also the youngest you’ll ever be.

Meaning there will never be a more advantageous time in your life to create your own Savings Explosion!

Do you enjoy my free blog? Share this article on your favorite social media or take advantage of free, awesome products like Personal Capital or Rakuten using this site’s affiliate links. (Like those two links!) Thanks for keeping this place alive!

Related Articles:

Hmmm. I guess I don’t understand your exact situation, but with taxes at 30% of $50k you’re only bringing in $35k Total. How do you pay for your own apartment and save more money than you make?

If someone is paying 30% taxes on $50K of income then I’d suggest they move.

In the United States, a single person pays:

10-12% taxes on their first $40K of income = $5,000 taxes

22% taxes on income from $40-50K = $2,000 taxes.

That’s $7,000 in total taxes, or 14% of $50K. You’d take home $43K.

Plus, if you max out your 401k and take the $12K standard tax deduction, your taxable income is only $18.5K. You would pay a grand total of $2,021 in taxes. That’s an effective tax rate of 4%, with $48K of take home pay.

Average rent $800 per month = $9600 per year

Food $200 per month = $2400 per year

Cell Phone $40 per month = $480 per year

Car insurance $500 per year

Car maintenance = $500 per year

Thats $13480 per year, bare minimum living like a rat, it doesn’t include vacation or any other expense, no going out no eating out, just from work and home.

Yep, and $48K – $13K = $35K saved.

You could even blow $15K on a vacation every year and still save $20K, which will get you a million dollar portfolio after just 5-6 years.

And if you negotiate an above average salary or spend an hour or two a week side hustling, you’ll be living like a king.

Where are you getting the 30% from and in relation to what?

I assume that (going by today’s tax brackets and 401k contributions) with a $50k salary, maxing out your 401k alone of $19,500 would lower your taxable income from the 22% tax bracket to the 12% meaning you’d only pay ~ $3,500 in federal income taxes. After (not counting state) taxes he’d have ~$27k left of which he’d need to save $15,500 to hit that 35k savings mark in total. This would leave him with $11,500 (a little over $950/month) to live off of, which is totally doable depending on how good you are at budgeting.

Exactly.

Except you’d pay even less taxes because the standard deduction also reduces your taxable income by $12,000.

You are not considering payroll taxes if 7.65% and state taxes.

In this scenario, how do you balance saving for the long term (retirement) vs short term (house, wedding, life)? Is that $35,000 all going towards retirement goals?

All long term.

Justifying short term spending (house, wedding, etc.) as necessary expenses is usually one of the most common ways people stretch themselves way too far financially. IMO, better to just get the heavy lifting out of the way ASAP so you’re set for life early. Then you can do whatever you want for the next 50 years.

Don’t even get me started on weddings…

https://mymoneywizard.com/average-cost-of-wedding/

https://mymoneywizard.com/diamond-engagement-ring-scam/

Just finished my BS in engineering last weekend and your articles have me extremely excited to start saving when I get my first salaried job. Appreciate all the advice and tips you’ve written Sean!

Awesome!!!

Come out of the gates swinging and you’ll be thanking yourself for the rest of your life!

Good luck!

Get to that first $100k invested in index funds ASAP & let compounding do the heavy lifting from there.

Truth!

Great way of illustrating the power of compounding and the importance of “time in the market”. Also, I hope today is not the oldest I’ll ever be 😉

Haha, nice catch. Fixed!

Hi MW, good article. In my journey to the FIRE state, the massive savings explosion was triggered as follows. At the risk of preaching to the choir, here they are.

1. Crushed all my outstanding debt related to mortgage and cars. Explosion started here.

2. Never took on new debt or went go on a spending spree after #1.

3. I kept paying down the outstanding debt, and saved+invested consistently and do so to-date. I did

not wait until I paid off all my debt to start the savings explosion. In just 5-6 years, I saved a lot of cash, and maxed out contributions to my non-taxable (medical, retirement, education) and taxable investment accounts.

4. While doing #3, I pursued opportunities to cut down expenses, creating more cash at my disposal to save+invest.

5. What I could have done was start saving and investing a bit earlier in my career, but better late than never:-). However, this is something I have encouraged my kids to do after they started their first job out of college.

So, using the 5-headed spear will help anybody strike their respective FIRE targets. Never get mired in excuses.

Great info!

Out of college, I did not apply myself and simply kept the service job I had during college (~$11/hour), along with some freelance work on the side (a few thousand dollars a year). I pulled my tax returns from that time – I earned pre-tax ~$23,500. The only saving I did during this time was paying the minimum on my student loans and a small Traditional IRA contribution that was automatically deducted from my paycheck that I was unaware of. But I definitely lived it up on this small hourly wage – I had an apartment in a nice Philly suburb (with a roommate – though separate rooms), went out to eat at very nice restaurants all the time, bought extremely nice beers, went to the movies all the time, etc. etc. I could have definitely been saving at least $5,000/year on this small wage by making some small cuts – cooking more, going to the movies less, cutting back on nice restaurants/beers, etc.

Now, working a high paid (but very demanding) job with often long hours, along with being married with two kids – I also look back at all the time and mental energy I had back then that I wasted. I could have certainly been making more money on the side, learning new skills, or simply applying to better-paying jobs.

If you are young, unmarried, and have a $50K salary – there’s no excuse not to save massive amounts.

Thanks for sharing your story, Mike. Really insightful.

Great article! I agree with the person above, there’s no excuse not to save aggressively when you’re young and childless but I’m also speaking from a place of privilege – had a good education and that has allowed me to make a pretty high salary now (and being married and splitting up costs help, too). I don’t think things are as easy for others who haven’t had the same opportunities. That said, I believe deeply in shaping your own destiny and not letting life take you in whatever direction, you need to steer life in the direction you want it to go. A lot of people fail that part, and end up looking back and regretting the decisions they’ve made…

I like this article ( and I like most of your stuff ). The only thing I find missing here to make it more realistic is that each $1 you invest at age 25 is worth about $11 by age 60. ($10.68, assuming 7% returns) does not account for inflation, so $11 when I’m 60 maybe buys a gallon of gas or milk or who know. Certainly it’s far better to start early since $0 saved is still $0 when your 60. I’d be interested in seeing you include inflation and buying power over the span of average earnings. Great stuff. I really enjoy your blog.

It does account for inflation. The average stock market return AFTER inflation is 7%. See this article:

https://mymoneywizard.com/average-stock-market-return/

Your concern would be legit if someone is assuming 10-11% stock market returns.

That’s two great postings back-to-back. Brilliant. For a while there, it felt like you were losing interest in the blog and just mailing it in (and I’m sure living in Minneapolis, and sorting out the wedding has been a challenge this past year or so). When you are on board, you’re streets ahead of the other personal finance bloggers. It’s irrelevant if you’re right or wrong; just keep firing away with your viewpoints and challenging the younger generations. Just my observation.

Appreciate the honest feedback, Ian!

It’s some posts like these that make me think that I’m over-saving for my retirement. I think I have the one year syndrome where I want to supercharge my savings just one more year, unless another pandemic happens, then I can fiiiiinally let loose and spend with limited restrictions.

I think it’s doable at least when one is single and before family and kids.

Thought provoking! Thanks for showing us the numbers.

This is super cool, I do have a question: is this $35k inclusive of your maxed our 401k and Roth accounts? Great blog btw!!