It’s that time of year!

That time when 365 days of ridiculous tracking of my money gets shared with YOU. (And the rest of the world…)

As always, this year’s report includes every single cent I spent, every dollar I saved, and even something most personal finance bloggers are shaking in their boots to admit – every dollar I got paid!

Last Year’s Budget – $36,000

You might remember that I made a drastic change to my budget last year.

After getting slapped with the realization that my current rate of savings would likely have me reach age 60 with anywhere from $4-8 *MILLION* dollars…

…I had to face the harsh reality that I might actually be saving too much money.

(Not an easy thing for a frugal blogger to admit!)

Balance is the key to life, or so I’ve been told from the yin yang logo.

So, I made a change.

Heading into 2020, I upped my monthly spending by about $500. With an extra $6,000 a year earmarked for doing whatever-the-heck I want, I had dreams of venturing out from my roots in the frugal forest and going as hog-wild as drunk dude at a Vegas bachelor party.

But like all good plans, things immediately went sideways.

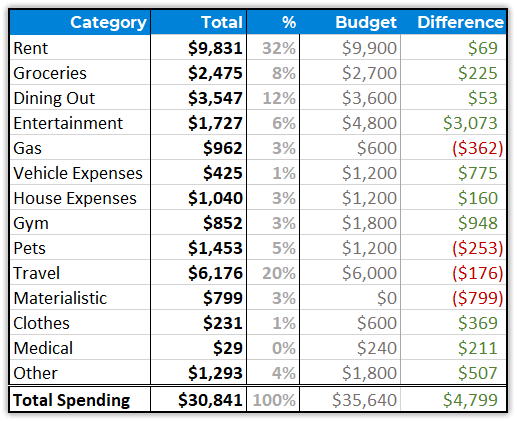

How Much I Actually Spent in 2020 – $30,841

Old habits die hard, apparently.

In 2020, I failed to meet my extra spending goals by $5,000, and I’m still not sure if that’s a good or bad thing?

Interestingly, this is almost the exact same amount I spend in 2019. And even less than I spent in 2018!

- 2020 Spending: $30,841

- 2019 Spending: $29,780

- 2018 Spending: $33,893

It turns out, with the help of a nation-wide lockdown, pretending to be a drunk dude on a bachelor party in Vegas isn’t easy when there are no bachelor parties and no trips to Vegas.

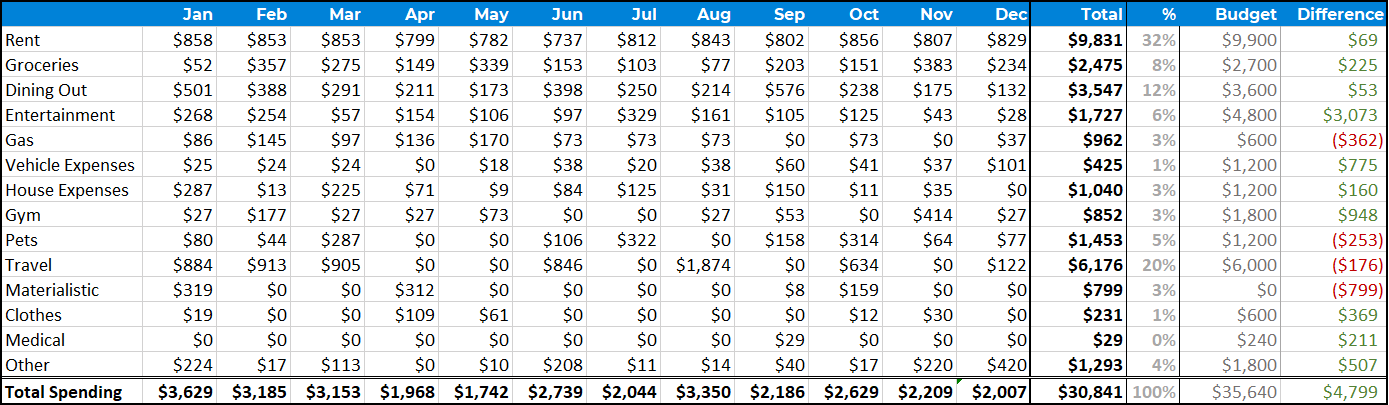

The Super-Detailed Monthly Spending Chart (2020 Edition)

Rent: $9,381 (32% of Total Spending)

Without question, this is the #1 cheat code that helps me save so much money.

Regular readers know that a few years ago, Lady Money Wizard and I started looking for a house. Based on our incomes, the standard advice would have had us saddled with an oversized home and a $500,000 mortgage.

We’d have been drowning!

Instead, we found a $180,000 beauty in a modest neighborhood, and quickly put another $15K into an open floor plan kitchen remodel.

Since then, our modest ~1,200 square feet has been absolutely perfect for us and the pets, and I can honestly say I never find myself day dreaming about something bigger or more expensive.

But the most interesting development on this front is that our housing costs, as a percentage of annual spending, actually went went down, from 33% last year to 32% this year. I view this as a sign of one of the biggest benefits of owning your own place – you actually lock in your mortgage payment at current price levels, forever. As inflation continues to rise through 2020 and beyond, we’re still paying our “rent” at 2018 prices. Pretty sweet deal!

Groceries: $2,475 (8%)

That’s about $48 per week, which is up from our usual $35 per week on groceries. Not surprising with all the quarantine home cooking.

Dining Out: $3,547 (12%)

I’m a sucker for a fancy meal out, and when I upped this year’s budget, dining out was the first category I was excited to go wild with.

COVID did its best to put a damper on that spending, but we fought back!

Knowing a ton of local restaurants were struggling we were not, we made a conscious effort to get lots of take out from our favorite locally owned spots. At times I actually viewed this spending like giving to a community charity, which is an impressive feat of mental jujitsu to help justify something I really wanted to do anyway.

We humans are funny like that…

Entertainment: $1,747 (6%)

Another category that COVID put the big kabosh on. Apparently, board games and zoom calls are less expensive than live concerts and sporting events. Who knew?

Vehicle Expenses: $962 (3%)

The $13,000 Mazda 3 is up to 35,000 miles and was shockingly cheap to own in 2020. (About $500 under budget.)

Fate loves irony though, which is probably why just a couple days into 2021, I hit a patch of ice and found myself saddled with a $1,000 deductible to fix my shattered headlight and bumper.

You just gotta laugh at 30 seconds of driving costing you more than the past 365 days. An important reminder for how quickly things can go sour behind a wheel. And if those things can be fixed with money, I should count myself lucky.

Gas: $425 (1%)

Average mpg on the year – 35.4!

House Expenses: $1,040 (3%)

I’m considering axing this category all together.

My “rent” payment includes about $150 per month to a home maintenance fund that Lady Money Wizard and I use to fund any big projects. So in reality, this category is usually just the stuff that we accidentally pay out of our normal account. (Or when we’re too lazy to make a transfer to track things properly.)

Gym: $852 (3%)

When COVID hit, I traded my gym membership for a $375 Peloton knockoff and a $30 set of gymnastics rings. So far, I’m really enjoying it, and I may never go back to a Globo-Gym again.

Pets: $1,453 (5%)

These guys ain’t cheap. But can you put a price on this loving family!?

Travel: $6,176 (20%)

This was the most surprising category for me.

After March, I didn’t take a single flight in 2020. What’s more, Lady Money Wizard and I traded the usual trips to Costa Rica and Alaska for the likes of Northern Shore, Minnesota and Upper Peninsula, Michigan.

And still, somehow I went over budget!

Note to self… definitely need to up the travel budget when things open back up…

…Just don’t want to get caught in a February 2021 Cancun Airport crowd (real pic below)

Materialistic: $799 (3%)

Interestingly, this really came down to just three major purchases. Two of which I consider to be some of the best money I spent all year:

- A $100 pair of running shoes. 2020 will go down as the first year of my life that I started enjoying running. This is absolutely shocking for a guy who used to think running was just something angry high-school coaches made you do whenever you were in trouble. Instead, I found myself addicted to the freeing feeling of moving those feet, and I got a little obsessed with trying to get my one-mile time as low as possible. (From gasping for breath and worried I might keel over and die at 9 minutes per mile to right around 7 minutes flat… hoping to hit a 6 minute mile in 2021!)

- A $300 Vitamix blender: This might be one of the most life changing things I ever bought. I now have healthy smoothies 3-5 times per week, and I feel great.

- A $150 Demeyere Sauce Pan: Cooking at home so much made me want to upgrade some tools. (And avoid terrifying Teflon coating flaking off and giving me cancer…)

Medical: $29 (0%)

Truly, the most important category. Especially with everything going on in the world this year.

Wealth is nothing without health. I couldn’t feel more fortunate.

Other: $1,293 (4%)

Mostly gifts and some charitable giving.

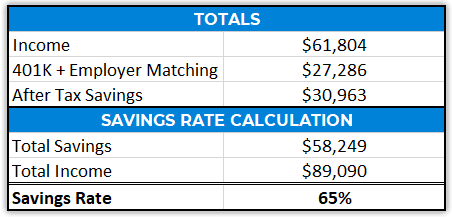

Total 2020 Savings: $58,249 (65% Savings Rate)

Okay, that’s just redonkulous…

The first thing that needs to be said up front is that I made a lot of money in 2020.

I was extremely fortunate to keep my job in a year when many weren’t. And that job paid a salary around $105,000 which resulted in an after-tax income of around $62K.

From there, my weak attempt at upping my annual spending meant I still saved $30,963 of that take home pay. Mixed with $19,500 of my own contributions to my 401K plus my employer’s matching, I was able to save a total of $58,249 during the year.

Here’s the wild part, though. Compound interest was even more powerful than my salary was, again proving that your money can work harder than you can. (Even if you have a high paying job…)

- During 2020, my net worth increased from $353,011 to $473,457.

- $58,429 of that increase was from my own savings, while $62,017 was from return on investments.

(Also interesting that those investment returns doubled my annual spending. In other words, I could have hypothetically had no job this year and still grown my net worth by about $30K. Sure, it was a crazy bull year in the stock market, but this is definitely a sign that I’m getting really, really close to financial freedom!)

Random Notes:

- This is only my info and does not include any of Lady Money Wizard’s earnings or savings. (We planned on combining finances when we got married, but we delayed the wedding because of COVID. Hopefully in 2021!)

- Income from this blog isn’t counted. I keep those earnings in a separate account in an effort to keep this blog’s experiment as relatable to the average office worker as possible. Maybe one day I’ll pursue some fun investments with those earnings?

What this article means for you

I have no idea.

But hopefully this TMI level of transparency was helpful to you in some way.

These days, my salary is definitely getting higher, but the fundamentals are still the same.

- Focused savings on the only 3 expenses that matter. No matter how high my salary was, it wouldn’t have mattered if I blew it all on an expensive house or overpriced car. Instead, living FAR below my means on these three categories helped pour some gasoline on my fire of savings. (Same as when I was a new-grad making $50K)

- Steady contributions into low cost investments. It’s easy to get distracted by my recent dabbling in cryptocurrencies, but in 2020, over 80% of my investments were still dollar cost averaged into Vanguard’s Total Stock Market Index Fund or similar 401(k) index funds.

Thanks for reading!

PS – If you want the spreadsheet I used to calculate all this, be sure to sign up for the Money Wizard newsletter. I’ll be releasing it exclusively to email subscribers soon!

Related Articles:

I really appreciate your detailed spending report! One comment: Using the term “OCD” to mean “very meticulous” can be hurtful to people who are actually diagnosed with OCD (not all, but I certainly know some who would find the casual use of “OCD” offensive at worst, lazy at best). Please consider using an alternative. Thank you.

I was actually going to comment on this, as well. This is an awesome blog post! I love the transparency and attention to detail! Thank you for your money lessons. I love your blog! Describing this attention to detail as “OCD” isn’t really what OCD is, as those who have been diagnosed with this can attest to. It is the same as someone who is super neat or clean saying, “I’m so OCD.” That isn’t at all what OCD is and should not be used as an adjective. Thank you for listening 🙂

I love this detailed spending summary as I too am an OCD budgeter. For the life of me though, I can’t understand how your grocery spending is so low! I live in a medium sized city in Canada and for myself and my husband, we spend about $1000 a month on groceries/personal care. I like to think of myself as a frugal shopper but your grocery line item makes me think perhaps I have to learn a bit more in this spending category.

I do split a lot of grocery costs with Lady Money Wizard, so if I were measuring for two then our true spending may have been closer to $75 a month.

You might like my article about 15 tips to save money on groceries.

The travel budget is a surprise!

We just drove to our place in Lake Tahoe, so that didn’t cost much.

It’s interesting to think that if there was no travel, the virus might have been contained sooner.

But I guess America is more the land of YOLO!

What is your ideal great life spending amount?

Good question, Sam. I thought it might be $36,000, but I’m clearly gonna have to do a mulligan on that experiment.

Also just to be clear, after March our “travel” consisted of driving to secluded cabins. (About 3 trips in 9 months) So hopefully we didn’t YOLO ourselves into super-spreader status.

Hey, long time reader, and I love the breakdown of budget to the fine details. Enjoy the humor too (Vegas with no Vegas… that’s so 2020). Agree with the previous poster about how misapplying the word OCD is unintentionally harmful to the OCD community. You’re not trapped in a need to re-check your budget, to do it again and again and again. And again. Perhaps “nitty gritty” or “uber-detailed” would give the verbal pizazz you’re looking for, and you are good with crafting, without dipping into ableism in language. It’s just a kind gesture to the people who have this medical condition, on a daily basis and they can’t opt out of it, while not too hard for us to just reach for a pizazzier synonym that doesn’t conflate ‘detailed’ with anxiety compulsions.

That is A LOT of taxes… I’m assuming a good chunk of that is state income tax?

Living in a no income tax state or looking at living abroad in a country that has favorable tax policies and costs of living would mean you could probably retire now if you truly wanted to, even without the crazy bull market.

Yeah, my state income tax rate in Minnesota is 7.85%.

Is living here worth ~$8,000 a year? That’s one of the first questions I’ll ask in early retirement.

Congrats on a great year. Hopefully you have a 2021 budget post on its way!

1) On a $105K salary, your take-home was $61K. But then if you add your 401 contributions of $20K, then you only paid around $24K in taxes, which is about right and not exorbitant at all. In effect, your real take-home is around $81K correct?

2) When you retire, you won’t be earning $100K so you will not be paying $8K per year in state taxes.

Both true!

Another great year in the books. I appreciate your gratitude scattered throughout this, lots to be grateful for in a difficult year. Awesome to see that this was a year where your assets generated more wealth than your savings rate!

With regards to your blog money, I think it could be interesting to put a percentage of that money into various cryptos to see how it performs over time and comparing that data to other “legit” index funds putting in the same amount of money into both.

I know you have a portion of your savings already in crypto, but it could be fun.

Interesting!

I’ve also considered using it for a downpayment on a rental property, but we all know my woes with pulling the trigger on one of those.

Would love to hear reader opinions on what I should do with it.

Nice work! I assume that healthcare premiums are paid by your company in full? If so that is great, because that is one of our biggest expenses right now. For a family of four it is RIDICULOUS.

They pay for a huge chunk of the premiums… something like 80-90%. I do pay about $50 a month though. I don’t see a big benefit in tracking it since it gets deducted before I receive my take home pay, and in early retirement the cost would be so different anyway.

Makes sense. We are paying ~$20K a year right now for health insurance. But alas, that is what I get for retiring early and such and wanting to keep our insurance the same during COVID.

I have loved reading your blog posts and have appreciated your detailed accounting of expenses. But, having suffered from OCD for the majority of my life now, I feel the need to post a link to an article. Please do have a read:

https://fhspost.com/ocd-is-not-a-quirk-stopping-the-glorification-of-ocd/

Cheers!

Sorry – edited the post.

Hi,

Are utility costs in your house expenses as well? (Gas, electric, water, garbage).

Others:

Cell phone, internet, Netflix?

Car expense. $425 seems low for tabs and car insurance on a newer car in Mn.

Didn’t you used to get your house cleaned?

Just curious about the things that I have in my budget and always on the lookout for new ideas.

Yeah, utilities are included in my monthly rent payment. Some things get paid for quarterly, so I usually track those in the “House Expense” category. (Water and garbage off the top of my head)

Cellphone is paid by my employer.

The house cleaner is under house expenses, but we cut back on this big time when COVID hit. I think she only came two or three times since March.

Good catch on the car insurance. I pay $73 a month for that or about $800 a year. It looks like “vehicle expenses” and “gas” got switched in my summary table, I’ll have to fix that – thanks! (Not sure why I wasn’t charged for car insurance in September or November… will have to double check.)

It’s interesting that this quote is true despite a pandemic… “it was a crazy bull year in the stock market”

I love your breakdowns! So helpful to be able to have numbers to compare/contrast with someone who is financially frugal. Can be difficult with friends and the awkward tension that comes with discussing money to have an idea of how you rank with peers in terms of spending, saving, and budgeting.

I know you already have a home, but one thing I’ve been curious to see you write an article on for a while is how you would plan to purchase a new home. Either as an investment property or as a hypothetical. Would you use IRA funds? Save cash and defer contributions to your portfolio? What are your thoughts on down payment percentage (ie. 3-5%, 20% worth getting rid of PMI, etc.)

Thanks for the content!

Thanks, Chad!

Good idea for an article!

Twiddling my thumbs and patiently waiting for your $500,000 networth article to come out. I’ve been following you for a year or so and we have very similar networths – almost exact for the past year. I hit the 500K this month. Secretly having a a competition of sorts with you in my head. Lol. Thanks for the motivation and continue to look forward to your posts.

Thank you for sharing this! Do you categorize and export this information from Personal Capital? Or do you track these in categories separately somehow? New to the Personal Capital tool and I’m looking forward to familiarizing myself with all it can do.

HI MW,

Congrats on another great financial year! Random question from the article… what was the $375 Peloton knockoff you bought?

Been looking for one but haven’t found one I feel comfortable committing to yet.

Thanks!

Hello-what bike did you get instead of the Peloton? I want to get something soon

It was the Pro Form Tour De France, on sale at Costco. I don’t think they sell the exact model anymore.

Come on MyMoneyWizard, I was looking for the additional $6,000 a year that you’ve budgeted for!

Just kidding. The pandemic definitely made it easier for people to save money. I can’t remember the last time that I just spent money for the heck of it… I would really really really like to.

Once the pandemic is over and people are allowed to go out again, I will unleash the inner pent up demand and enjoy life again. This is too much!